Politics

The Nonsense of the “Tariff Men”

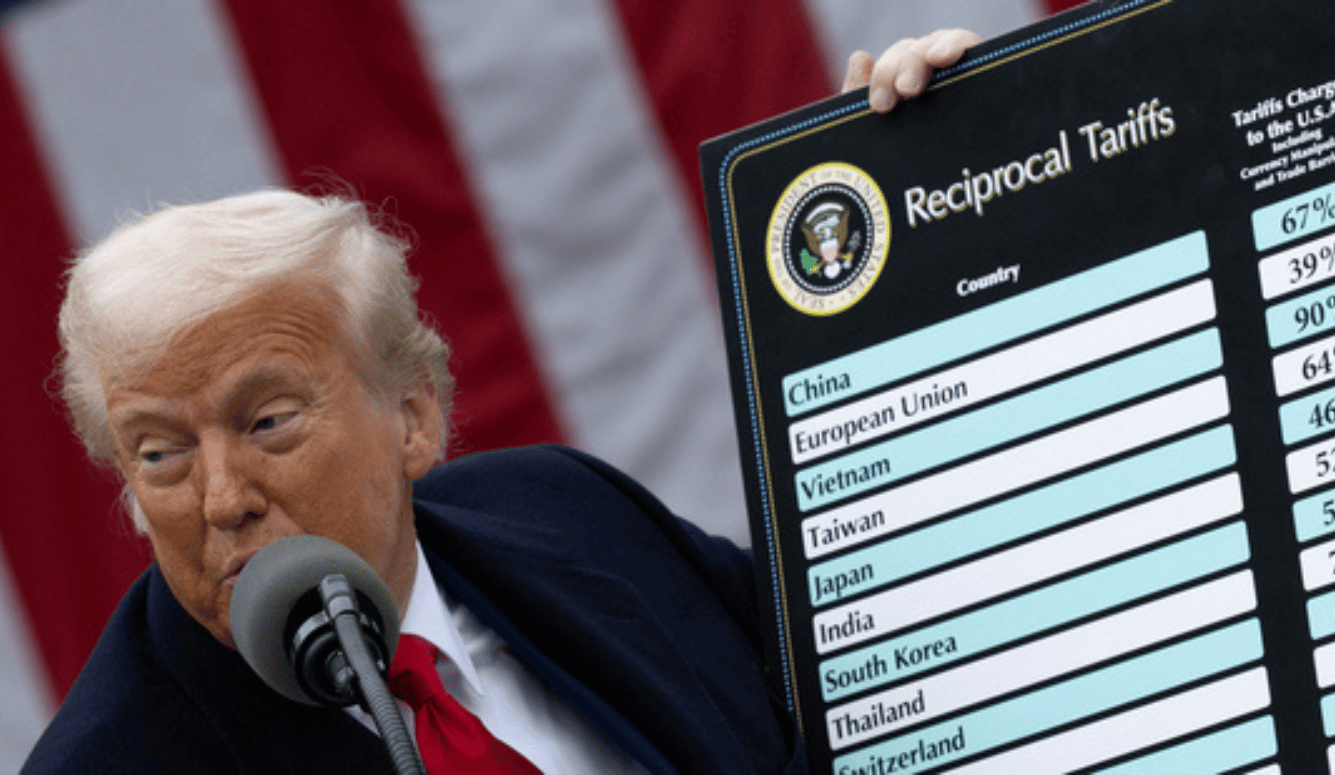

President Trump’s protectionist policies are erratic, ill-defined, and incoherent.

President Donald Trump’s tariff agenda exhibits no signs of a popular mandate. Recent polling found that 61 percent of the public believe raising tariffs will hurt average Americans, compared to just fourteen percent who see them as helpful. Seventy-six percent expect tariffs will produce increased prices at the store. Clear majorities also oppose Trump’s specific tariff measures against Canada and Mexico. Mainstream economists have panned the administration’s claims that their tariff program will “substantially reduce the US trade deficit.” Unlike past tariffs, which usually drew their support from special interest groups in the beneficiary industry, there does not even appear to be a concerted lobbying effort behind Trump’s current agenda.

The economy has also delivered a harsh verdict on the White House trade agenda. In the past month, a see-saw of stock-market nosedives and recoveries with each new tariff announcement has been replaced by economic free-fall. As of this writing, the Dow Jones has lost more than ten percent of its value since Trump’s inauguration in January and the S&P 500 has lost closer to fifteen percent. Tariff uncertainty has obliterated US consumer sentiment and international supply chains are preparing for a tariff-induced shock. The market dislikes tariffs in general, but it also abhors the uncertainty created by this haphazard roll-out.

At the most basic level, the president’s stubborn attachment to tariffs stems from an ideological belief. Trump is a self-described “tariff man” after all, and espousal of protectionism may be the most stable component of his political belief system over the past forty years. Yet Trump’s current tariff policy is also erratic, ill-defined, and incoherent. Its justification swings between the mutually exclusive goals of protecting industries through import-exclusion from abroad on one hand, and raising tax revenue from the very same imports as part of a scheme to replace income tax on the other.