Politics

The Road to Neo-Feudalism

Western societies stand on the brink of a great reversion towards a demographically and economically stagnant society reminiscent of the Dark Ages.

For middle- and working-class people across the developed world, home ownership has served as a primary driver of upward mobility. But in a growing number of places, this aspiration is being systematically undermined with grave implications for liberal democracy, the economy, and even fertility.

This phenomenon is recorded in the newly released 20th edition of Demographia International Housing Affordability, and it is found in virtually every high-income country. The gap between housing prices and incomes is greatest in large—usually left-leaning—metropolitan areas, including Sydney, which has the highest gap between household income and home prices outside of Hong Kong. Sydney is followed closely by Los Angeles, San Francisco, Toronto, Melbourne, Adelaide, and Vancouver.

Indeed, according to the OECD, house prices in high-income countries have been rising “three times faster than household median income over the last two decades.” Some of this can be attributed to things like population growth, but much of the harm has been self-inflicted, largely through policies that seek to restrict growth to already urbanised areas.

How to Destroy Housing Affordability

Ever since the introduction of Britain’s 1947 Town and Country Planning Act, planners have sought to rein in “sprawl” by restricting suburban and exurban growth. By the early 1970s, the legendary British planner Peter Hall suggested that the “speculative value” of land with planning permission in the UK was five to ten times higher than that of land without planning permission. He also concluded that the failure to prevent housing-affordability losses was “perhaps the biggest single failure” of urban containment in the UK.

The determination of planners—often cheered on by academics, politicians, and the media—has been to stop movement to the periphery with the aim of forcing people into “living smaller, living closer” whether they like it or not. This has boosted prices by delimiting—and even prohibiting—development on the periphery, where costs tend to be lower. The consequent price rises, some advocates of urban containment say, are intentional. As anti-sprawl advocates Arthur C. Nelson and Casey J. Dawkins have argued, urban containment “should decrease the value of land outside the boundary and increase the value of land inside the boundary.”

Rising prices have a particularly powerful impact on younger people and ethnic minorities, growing numbers of whom have been moving to suburban and exurban locations in the US, Britain, Australia, and Canada, but must cope with higher prices due to regulatory policies. This has been particularly notable in places like California, which has been imposing growth restrictions since the 1970s, leading to massive price inflation.

Since the 1970s, notes Dartmouth economist William Fischel, California’s policies have produced an extraordinary rise in housing prices. By 2019, California’s major coastal markets were the least affordable in the nation; the California Legislative Analyst’s Office reported that an average California home costs two-and-a-half times the national average, and the average monthly rent is about 50 percent higher. The 2020 Economic Report of the President found “a house price premium” of 100 percent in the Los Angeles and San Diego metro areas, and 150 percent in the San Francisco Bay Area. These premiums are a consequence of “excessive housing regulation.” The report also found that high prices drove rents up, due to the close relationship between the two.

Similar trends can also be found in other places that have adopted urban containment or compact-city strategies. In 2019, all of the 92 housing markets examined in Demographia International Housing Affordability areas with urban-containment policies were severely unaffordable. Today, according to the latest ACS data (2021), California ranks 49th out of the 50 states in home ownership, at 55.9 percent, slightly above lowest-ranked New York, at 55.4 percent. In contrast, none of the markets without such policies suffered the same result.

The big problem with these policies is that they run counter to the preferences of most of the public. The state makes it difficult to build single-family houses, the preference for which is “ubiquitous” in California and elsewhere, according to recent research conducted by Jessica Trounstine at the University of California, Merced. “Across every demographic subgroup analyzed,” she observes, respondents preferred single-family home developments by a wide margin. Relative to single-family homes, apartments are viewed as “decreasing property values, increasing crime rates, lowering school quality, increasing traffic, and decreasing desirability.”

Nearly three-in-five younger people may see homeownership as an essential part of the American dream. Some two-thirds say that the suburbs are their preferred area of residence, a trend that appears stronger today. Given these preferences, the mismatch between market preference and policy has produced a staggering decline in housing affordability across much of the Anglosphere.

Despite claims that densification would lower prices, an examination of US data suggests a positive correlation between greater density and housing costs. Among 53 major metros, those with more single-family housing and larger lot sizes (key indicators of lower density) have substantially better housing affordability. Nor have these policies encouraged new building, as demonstrated by the paltry California numbers compared to those in less regulated Texas, Florida, and Tennessee. Higher interest rates, the result of a tsunami of public debt, are now further squeezing supply.

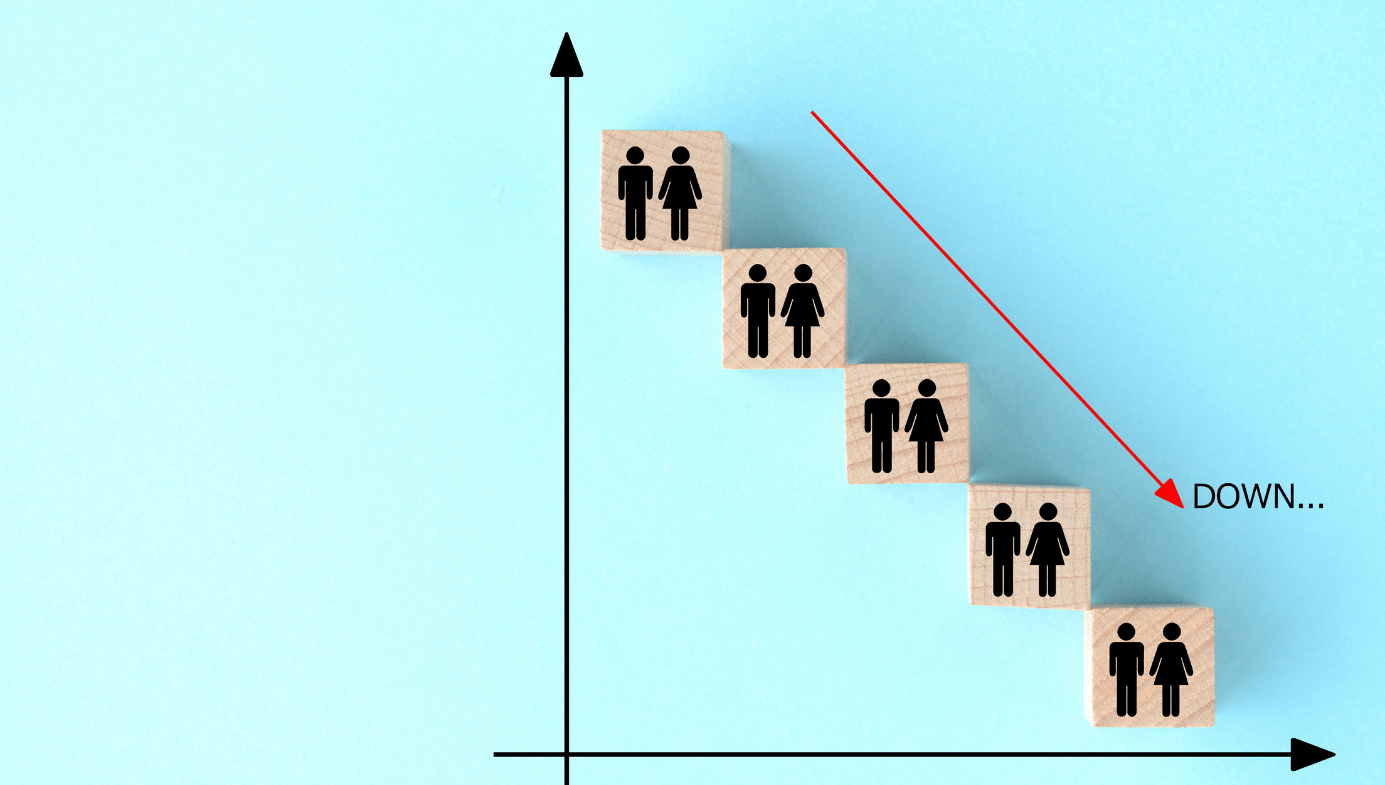

These factors have reduced homeownership across the Anglosphere. Overall, according to US Census Bureau data, the rate of homeownership among young adults at ages 25–34 was 45.4 percent for Generation X, but dropped to 37 percent for Millennials, the generation now entering family formation. The same can be seen in Australia. According to the Housing Industry Association, by 2022, regulatory taxes and costs designed to discourage “sprawl” in Sydney accounted for 50 percent of the price of a new dwelling. The 2023 Demographia International Housing Affordability Survey rates Sydney as among the most expensive cities in the world. Melbourne and Brisbane have also witnessed rapid deterioration in affordability.

Once renowned for its high levels of homeownership, Australia’s rate among those 25 to 34 years old dropped from more than 60 percent in 1981 to only 45 percent in 2016. The proportion of owner-occupied housing has dropped by ten percent in the last 25 years. Economist Saul Eslake suggests that the 2021 homeownership rate among Australians in their mid-20s to mid-30s will be lower than it was in the 1947 census.

Similarly, in the UK, the homeownership rate has plunged below 1985 rates, particularly for young families. Homeownership is also in decline in Canada, with the strongest drop occurring in heavily regulated British Columbia, a province dominated by impossibly unaffordable Vancouver.

The New Geography of Inequality

The decline of housing affordability drives rising inequality, notes a recent study by the Bank for International Settlements (Berne) economist Gianni La Cava. Traditionally, homeownership has been the most effective way for middle- and working-class people to achieve multi-generational wealth. According to Habitat for Humanity, homeowners have four times the net wealth of non-homeowners, and homeownership is still a “primary driver of household wealth.”

Yet the path to homeownership is being made more difficult. Today, financial oligarchs increasingly seize upon high prices to purchase ever-larger shares of the housing market. Wall Street firms like Blackstone and Britain’s Lloyd’s Bank increasingly buy homes in hot markets, turning them into unaffordable rentals and further boost home prices.

This is the road to neo-feudalism. The United States never experienced feudalism, but the proportion of land owned by the nation’s 100 largest private landowners grew by nearly 50 percent between 2007 and 2017. In more historically feudal Great Britain, land prices have risen dramatically over the past decade, and less than one percent of the population owns half of all the land.

In Capital in the Twenty-First Century, French economist Thomas Piketty identified property as a key factor in the widening of inequality around the world over recent decades, a conclusion also reached by Matthew Rognlie’s research at Northwestern University. Over the past decade, the proportion of real-estate wealth held by middle-class and working owners in the United States fell substantially while that controlled by the wealthy grew from under 20 percent to over 28 percent. At the same time, high-income households enjoyed 71 percent of all housing gains while the shares of middle- and lower-income families declined precipitously.

Even famously egalitarian Australia is seeing the rise of a rentier economy dominated by large landowners. In a detailed 2022 report titled “The Wealth Inequality Pandemic: COVID and Wealth Inequality,” the Australian Council of Social Services and the University of New South Wales concluded that, in recent decades, “the wealthiest 10 percent of Australian households held 46 percent of all wealth, while the next 30 percent held 38 percent of wealth. The majority of households—the lowest 60 percent—held collectively just 17 percent of all wealth.”

Increasingly, we are returning to a feudal structure where people purchase property through “the funnel of privilege.” Inherited wealth is becoming ever-more preponderant, notes Piketty, even in social democracies like Germany and France as well as in the US and Britain, which share a natural antipathy to the primacy of inherited wealth. US Millennials are three times as likely as Baby Boomers to count on inheritance for their retirement. Among the youngest cohort, those aged 18–22, over 60 percent see inheritance as their primary source of sustenance as they age.

Property and the Future of Liberal Democracy

Property ownership has defined class relations since ancient times. In the modern era, the expansion of European colonialists may have led to unspeakable consequences for native people, the enslaved, and the indentured servants, but it also nurtured a substantial class of independent smallholders who often demanded a constitutional order that would protect their assets. As the radical social theorist Barrington Moore argued in Social Origins of Dictatorship and Democracy a half-century ago, “no bourgeois, no democracy.”

Upward mobility and dispersed property ownership have proved to be “the secret sauce” that makes liberal capitalism palatable beyond the elites. A study covering the United Kingdom, the Netherlands, and the United States found that all three counties saw a rapid decline in the concentration of wealth between the 1820s and the 1970s. Between 1940 and 1950, the incomes of the bottom 40 percent of American workers surged by roughly 40 percent, while the gains in the top quintile were a modest eight percent and the top five percent saw their incomes drop slightly.

Australia has followed a similar pattern. In its early decades, Australia handed out grants to emancipated convicts and former marines who did not want to return to Britain. Australia’s opportunity horizon expanded with the land of settlement, such as the push to and beyond the Blue Mountains. This certainly threatened the aboriginal community, but it also provided settlers with opportunities far less available in the home country. In the immediate postcolonial era, the top one percent of the population owned 35 percent of the country’s wealth. But by the 1960s and 1970s, the top one percent controlled only six percent of the wealth. This was “peak egalitarian” Australia.

The Dispersionist Era Beckons

Instead of trying to make homeownership more difficult, policymakers need to find ways to accommodate the overwhelming aspiration, notably among Millennials and immigrants. Indeed, rather than being vehicles for “white flight,” the suburbs and exurbs should be seen as they are now—increasingly diverse in the US, Canada, Australia, and the UK.

The favoured argument against dispersion today lies with environmental concerns. But MIT professor Alan Berger believes that changes in technology, such as innovative materials and sophisticated systems for controlling energy and water use, could make suburban and exurban communities more environmentally sustainable. Well-planned new developments could reduce greenhouse gases by using rooftop solar systems, electric cars, and (eventually) autonomous taxis. And with their ample open space, these areas are ideal for enhancing biodiversity with their thriving populations of insects, birds, and mammals.

Work from home could further improve environmental quality in an era of dispersion. The International Energy Agency suggests that if everybody able to work from home worldwide were to do so for just one day a week, it would save around one percent of global oil consumption for road passenger transport per year—an annual decline of 24 million tonnes, and the equivalent of the bulk of Greater London’s annual CO2 emissions.

From an economic, social, and demographic perspective, now is the time to build the kind of housing most families want. A recent study by the Federal Reserve of Kansas City has already created conditions for a family friendly housing boom, as people can live further away, and spend more time being parents.

Just as important is a lack of spacious and affordable housing that will further weaken society by depressing birth rates to catastrophically low levels, with massive consequences for pensions, economic growth, and the labour force, as well as the dynamism associated with young people. Research in Germany and across 18 European and North American nations found that high housing prices defer family formation, leading to lower fertility rates.

Rather than seek to crowd people into cities, policies need to acknowledge that they aspire to something more than just a small rental apartment. This is already an important reason for the massive movements of people from places like California and New York to less expensive states like Florida, Texas, Tennessee, Arizona, and Georgia. Similar patterns can be observed in Australia and Canada.

Ultimately, a successful society needs to be sustainable—not just environmentally but also by meeting the aspirations of families. Without extending the prospect of ownership, we face the prospect of a return to a feudal reality, in which property and power are concentrated within a small elite class and the state.

Today, Western societies stand on the brink of a great reversion towards a demographically and economically stagnant society reminiscent of the Dark Ages. We can reverse these trends only if policymakers and politicians move from constraining human aspirations to finding sustainable ways to meet them.