Politics

Piketty’s Progress

A review of A Brief History of Equality by Thomas Piketty, Belknap Press, 288 pages (April 2022)

As I write this, the city of Rotterdam is considering a request to dismantle one of its historic bridges to grant Jeff Bezos’s super-yacht (too monstrous for normal ports) safe passage to the Atlantic. At the same time, Amazon workers around the world continue to fight to secure the living wages and safe working conditions they are currently denied. Such juxtapositions are fraught with appalling symbolism—the vulgar display of wealth, the mutilation of national monuments, the outsized influence the rich have over public policy, the gulf that exists between CEOs and their employees. Moreover, Bezos’s wealth doubled to $170 billion during the pandemic, when over 160 million people worldwide were threatened with poverty. This merely reaffirms what we already know: staggering inequality continues to thrive in advanced capitalist societies.

This kind of inequality is not news, of course, but we need to be regularly reminded of it. The great chronicler of inequality in our time is the French economist, Thomas Piketty. The author of several tomes, Piketty’s works are not for the weak of wrist: Capital in the Twenty-First Century (2013) clocks in at 816 pages, while its follow up, Capital & Ideology (2020), breaches 1,000. Heavily graphed and annotated, reading them from front to back is a labor in itself. Volume aside, Piketty’s books are massively popular and widely praised, though one suspects, as with all big and difficult books, that most people have not read them in full, and much of their praise comes in under the pressure of consensus. Fortunately, Piketty’s new book is mercifully brief. Indeed, A Brief History of Equality (at less than 300 pages) is a nice distillation of the “rockstar” economist’s ideas and a good entry point for the uninitiated.

Piketty’s research sits at the intersection of history and social science, and his great contribution has been to show that tax records are as important to understanding and learning from history as anything else. In tracking the distribution of wealth since the beginning of the modern era, Piketty’s thesis is elegantly intelligible and empirically obvious: if return on capital consistently outpaces growth, it will invariably lead to a concentration of wealth, thereby producing inequality. The stress here is on inequality of opportunity, as Piketty’s argument for a more robust welfare state is more a matter of degree. He is careful to remind us that a measure of inequality between social groups can be productive, and that there is no universal formula for eliminating it. But he also points out that an unequal concentration of wealth is bad for growth and corrosive to democracy, precisely because it limits social mobility and prevents people from accessing key institutions.

This argument is not new. Aristotle made the same case in his Politics, positing that since all systems bend towards the concentration of power, and power tends to concentrate in the hands of those that have wealth, the interests of the governing will naturally diverge from those of the governed unless some correction takes place. The point at which this divergence becomes unmanageable, a decision has to be made—either reduce democracy, or increase people’s access to institutions. In defense of the latter, Aristotle proposed that property be distributed more widely among the middle class, allowing it to participate more fully in the democratic process and aligning its interests with that of the ruling class. Thus we see, in fourth century Athens, the conception of the first welfare state, and the reasoning behind it remains at the heart of progressivist politics to this day: a large and prosperous middle class encourages mobility, strengthens democracy, restrains oligarchy, and stabilizes society.

Piketty points out that “Property is a historically situated notion,” largely dependent on “the way each society defines legitimate forms of ownership,” which has shifted over time. Rousseau, who argued that people are truly equal only in the state of nature, identified the hoarding of property as one of the origins of inequality: “The first man who, having enclosed a piece of land, thought of saying ‘This is mine’ and found people simple enough to believe him, was the true founder of civil society.” Marx could only imagine the abolition of property as the way to social equality, but Piketty falls within the tradition of Thomas Paine and Henry George who called for the taxation of property as a means of redistributing wealth.

Piketty echoes Paine specifically in the concept of “inheritance for all,” an idea that Paine advanced during the French Revolution in the form of a land tax. This could be used to finance social security not just for those at the end of their life, but for those at the beginning as well. This universal inheritance, which Piketty argues could be financed by a global wealth tax, would be accessible to everyone upon reaching the age of maturity. The goal is not simply to punish the rich for the comfort of the poor (a common mischaracterization of Piketty’s ideas), but to enhance the social mobility of young people by increasing their buying and bargaining power (impossible in a condition of insecurity), instead of saddling them with student debt equivalent to a mortgage before they reach the age of 25.

The tradition into which Piketty-economics fits goes by various names, but Piketty calls it “Participatory Socialism”—participatory precisely because it eschews the movement towards the bureaucracy and centralization that characterized Soviet-style socialism. It focuses on giving people greater access to institutions, with the goal of “allow[ing] all citizens to participate more fully in social and economic life.”

One participatory reform would be adopting a co-determinate structure for businesses, like the so-called Mitbestimmung model in Germany, where as many as one-third to half of the seats on boards of directors are given to worker representatives. This approach, Piketty reminds us, has certainly not weakened the productivity of the German economy since it was introduced nearly a century ago. In addition to being a more democratic compromise between management and workers, it would constitute a legitimate investment in the company by employees (who are already investors by virtue of their employment), and would give them a greater stake in its prosperity, while also increasing the transparency of bookkeeping.

The central pillar of the Piketty model is a global system of progressive taxation, with high corporate and income tax rates aimed at the wealthiest one percent. Exactly how high these rates should be, Piketty (a mild prescriptivist) leaves open, though he makes it clear that it should be much higher than it is now in most countries. In the United States, one might propose a top marginal tax rate of 81 percent. If that sounds like communism, it is worth remembering that this was in fact the American tax code between 1932 and 1980. So, the popular objection that progressive taxation of this kind might work in Europe, but that it would never be acceptable in the United States (because it would be “un-American”) is simply ahistorical.

A good deal of A Brief History of Equality consists of reminding readers that these policies, far from being unrealistic or utopian, either exist currently or have existed at some point in the past. In many ways, Piketty is asking us to return to the economic models that were put in place in Europe and North America between 1914–1980. Piketty calls this era “The Great Redistribution,” when income inequality decreased dramatically. To be sure, this redistribution would not have been possible without a series of catastrophes—disaster being the great leveler. Within the space of four decades, revolutions, two world wars, and an economic depression destroyed much of the inherited wealth of the European aristocracy (the gap was closed as much by the self-immolation of the rich as it was by raising up the poor).

The Great Redistribution, however, was also (and in large part) due to the rise of the welfare state, which could not have happened without changing people’s view of the role that governments play in markets. And here it is important to recognize that many of these initiatives, like the New Deal, were not merely acts of noblesse oblige, but compromises aimed at alleviating pressure from socialist and labor movements, and implemented partly to quell radicalism and avert the threat of revolution.

The movement towards greater equality among the classes accelerated tremendously during this period, and it is along this line that Piketty recommends we continue. He shows—with data readily accessible to all—that developing more progressive taxation and furthering the potential of the welfare state does not come at the expense of productive efficiency and growth. The US economy, which is perhaps the best example of this, grew at an unprecedented rate between 1945–1980, a time of high tax rates and generous social spending. This legacy, however, has largely been gutted in the last 40 years, with the rise of neoliberalism (inaugurated by the Powell Memo), the wave of conservatism that overtook the West in the 1980s, and the abandonment of class politics by labor and social-democratic parties after the end of the Cold War. Since then, we have seen growth rates slow, contrary to the predictions of Reaganites and Thatcherites who insisted that deregulation and low corporate tax would spur innovation, create jobs, and “trickle down” more wealth to the rest of society.

The march toward equality, like the rest of history, is fraught with ironies. It is also not fixed and safe from reversal. The United States, for example, had a far more even distribution of wealth than most European societies in the 19th century. Today it has flipped. The French Revolution succeeded in establishing the principle of égalité, but failed to alter the distribution of wealth in France (Piketty shows that, in 1900, the wealthiest controlled roughly the same amount of property as they had a century before). These are good reasons not to be whiggish. There is a temptation to imagine our progress towards equality as a straight line, along which we will continue to travel, as the high tide of capital markets raises all boats. But there is no reason for us to believe that this will continue. The 21st century may well be one in which a surfeit of techno-billionaires reach new heights of obscene wealth, while a third of the population in post-industrial societies fall into poverty as their jobs are automated out of existence. That is, unless corrections are made.

The cause of creating a more equal society depends heavily on the strength of its social democracy and its willingness to renew the question of inequality. It was largely due to the efforts of social movements that we have things like free public education, universal health care, maternity leave, social security, unemployment insurance, worker’s rights, fixed salaries, the eight-hour work day, etc. We have no right to take these things for granted, as many of them were fiercely opposed at the time they were advocated, and had to be fought for, sometimes violently.

It is also important to remember that our sensibilities—and the institutions on which they are based—are not hardcoded. Regimes change, as does the prevailing sense of what is just and fair. The acceptability of these regimes largely depends on the ideas that hold them in place, and to that extent all economic policies are matters of “Ideology”—a word that Piketty doesn’t use as a pejorative. Indeed, there is little historical evidence to support the notion that a particular set of policies cannot be adopted on the basis that they are incompatible with some vague sense of “national character.” The French Revolution showed, albeit with much blood, that a country’s political organization and attitudes regarding equality can change radically in a very short time.

Sweden, which is often held up in the West as a model of democratic socialism, did not begin moving towards egalitarian policies until socialist parties took power after WWI. Until 1911, Sweden had censitary suffrage, according to which only the richest 20 percent could vote in elections, and the number of votes given to each citizen was proportionate to their wealth (we can see echoes of this today in campaign finance laws and rulings like Citizens United in the United States). We’ve also seen astonishing transformations in countries like Japan and Germany between 1910–1960, which transitioned from military aristocracies to fascist dictatorships to democratized welfare states in just a few decades.

The rapidity of these changes was sometimes a response to catastrophic events that demanded a radical restructuring of intuitions. But therein lies the lesson: societies that ignore inequality do so at their peril. Indeed, it was the abandonment of social democracy in Germany in the 1920s that weakened European socialism and created the vacuum that allowed parties like the Nazis to rise to power (a development predicted by Trotsky and confirmed by Hannah Arendt in The Origins of Totalitarianism). More still, it was the abandonment of a truly internationalist movement that made people susceptible to nationalist and statist politics that more readily adapted themselves to the demands of the interwar years.

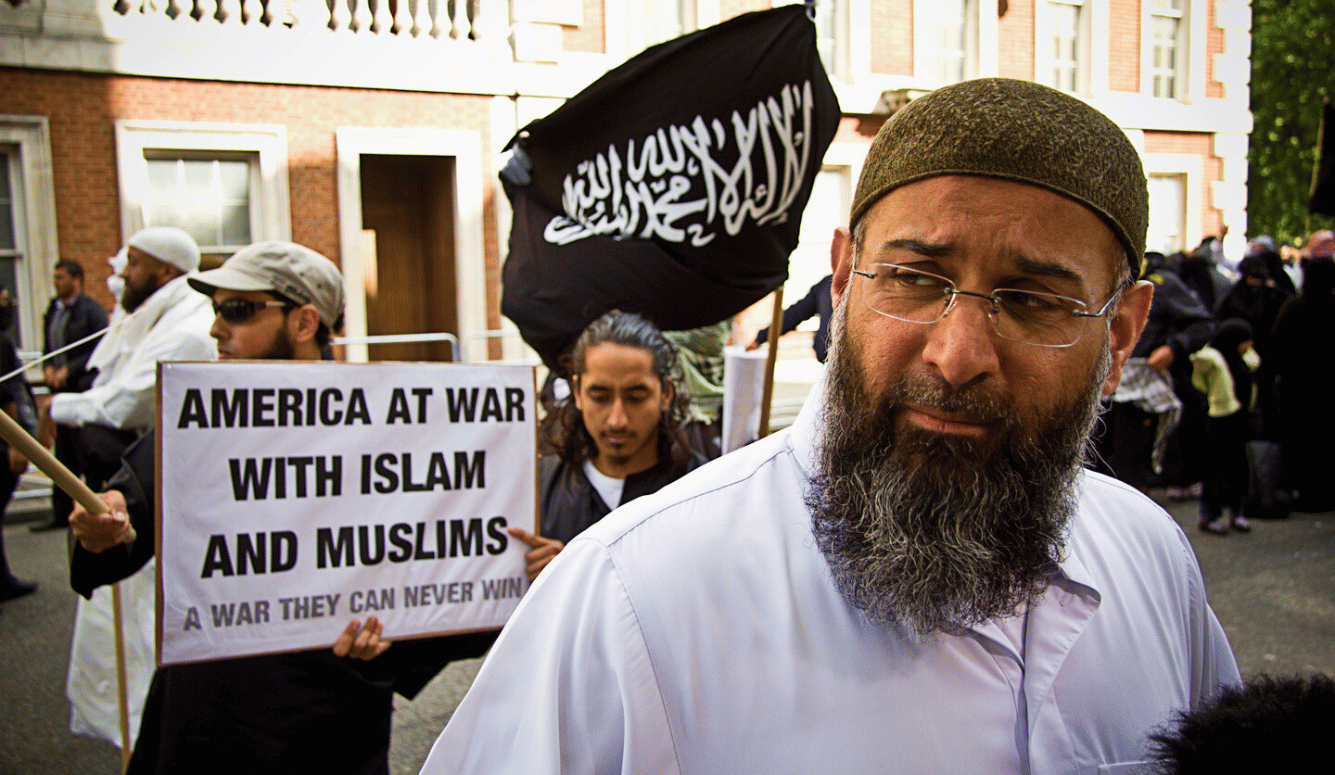

If the politics of Europe and America during the last decade have taught us anything, it is that the failure to address inequality is highly corrosive to the social contract. It fosters distrust and resentment, and makes people vulnerable to demagogy, populism, xenophobia, and reactionary politics of all kinds. Politicians who refuse to address the real source of inequality naturally have to search for other reasons to explain it, which usually involves finding scapegoats for people’s grievances—immigrants, foreign labor, foreign countries, etc. And if the problem of inequality is not addressed, the only way for the ruling class to protect its interests is to gradually erode democratic institutions.

This last point should be brought into sharper focus. Near the close of his argument, Piketty writes:

...if no democratic post-national project is formulated, then authoritarian constructions will take its place in order to propose more or less convincing solutions to the feelings of injustice engendered by the unrestrained economic and state forces operating on a world-wide scale.

One of the more honorable legacies of socialist movements in the 20th century was the recognition that the struggle for equality transcended all other identities (national, ethnic, religious) and that the project to improve the conditions of working people was essentially an international one. This, among other things, demanded an expansion of human solidarity. Sadly, we fail to see this same internationalism today, as societies across the West founder in nativist discourse, and tribalist thinking on the Left has displaced a debate once centered on a global critique of capital.

Perhaps rekindling a bit of this old internationalism is in order if we wish to crawl out of this rather ugly phase in our politics, and avoid the irony and humiliation of an authoritarian populism spearheaded by elites posing as saviors of “the forgotten.” This will require a return to certain principles, and a hardier debate within the Left. To that end, the march towards greater equality in the coming century may result from a debate between competing visions of socialism rather than a war between socialism and capitalism.