COVID-19

Winners and Losers: The Global Economy After COVID

Taking advantage of the post-pandemic era may start with securing national health but will depend over time on creating better conditions for adaptive grassroots businesses.

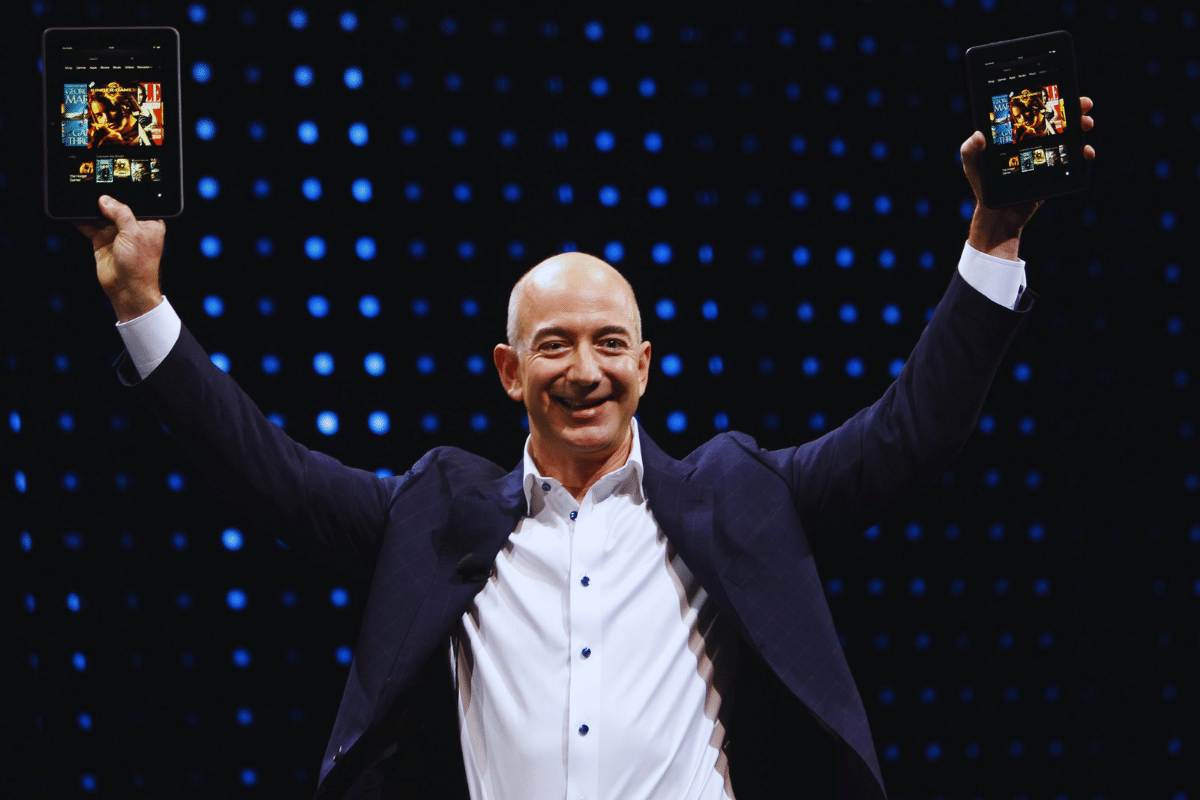

The COVID-19 pandemic has transformed the world economy in ways that will be debated by pundits and future historians for decades to come. Yet, as hard as it is to predict a disrupted future accurately, the pandemic (not to mention its probable successors) looks likely to produce clear economic winners and losers. The top digital companies—Amazon, Apple, Tencent, Microsoft, Google, Facebook, Ant, Netflix, and Hulu—have thrived during quarantines and the ongoing dispersion of work. These are the most obvious winners in what leftist author Naomi Klein has called a “Screen New Deal” that seeks to create a “permanent and profitable no-touch future.” Since 2019, Facebook, Apple, Amazon, Microsoft, and Google have added over two-and-a-half trillion dollars to their combined valuation, and all enjoyed record breaking profits in 2020.

But it’s not just the tech oligarchs who have benefited from the pandemic disruption. Companies that keep the basic economy functioning—firms dealing in logistics, for example, or critical metals or food processing—have become, if anything, even more important. With the shipping supply chain disrupted due to the pandemic, logistics giant Maersk is set to increase its inland-based operation with the acquisition of the Swiss-based broker KGH Customs Services. The company reported its best quarter ever in the first quarter of 2021, launching a $5 billion share buyback scheme. And although the developing world has been hit hard by declines in tourism and investment, mining giants such as Glencore are investing billions to challenge China’s market dominance in rare earth minerals. The global market for cobalt is expected to double by 2025 and has launched a new “scramble for Africa,” which is also raising moral questions about whether or not the green oligarch’s love of the planet outweighs human rights abuses such as the practice of child labor in the Democratic Republic of Congo.

Even some high street businesses which have taken major hits are finding new niches. Many small businesses may never return to pre-COVID levels, as people have become used to the convenience of online purchases. Nevertheless, some are finding new uses for redundant malls, and have discovered new ways to reach more customers using social media and technology. Lower property prices are also opening up potential opportunities for entrepreneurs in pricey places such as Manhattan, San Francisco, or London. Pestilence re-shapes economies.

In his 2017 book The Fate of Rome: Climate, Disease, and the End of an Empire, historian Kyle Harper argues that plague, as well as climate change, undermined the Roman empire, creating conditions that boosted the barbarian warlords who would later become the Medieval aristocracy. The lethal plagues of the Middle Ages likewise disrupted the great Mongol empire, at the time the largest in history, and in conjunction with cooling temperatures, undermined the stability of the great Silk Road and ended the Pax Mongolica.1 This opened the door to the Age of Exploration and Europe’s maritime conquest of the world. Within Medieval Europe, the Black Death killed as much as 40 percent of the population, but also precipitated the rise of the Third Estate, and in some places raised wages for scarce labor. “People were fewer,” noted historian Barbara Tuchman, “but they ate better. The pandemic also led to greater emphasis on long-distance navigation.”2

During the current crisis, disintermediation has been the primary driver of the post-pandemic economy. The novel coronavirus forced businesses to adapt quickly to new circumstances, and as with all economic crises, created winners and losers. The lockdowns accelerated the use of digital technology for work, retail, and entertainment. This has not only helped the big firms but also produced a whole crop of new startups, many of which address the shift to online work. The tech oligarchies now face competition from decentralized networks based on blockchain technology which is less vulnerable to domination by giant firms with algorithms that are designed to eliminate the incentive structures that lead to central node control and promote monopolistic behavior. Domains such as Lokinet, Ethereum, Odysee, and Urbit seek to give users ownership of their own data. Even Google’s near-monopoly of web browser supremacy is set to be challenged by data-privacy-conscious alternatives such as DuckDuckGo, which has seen a 62 percent growth in search results in 2020. Users are clearly becoming more conscious of privacy and data ownership.

The big losers in the transition have been the traditional middlemen—the insurance and travel agencies, the local banks, the high street retailers—a large part of the post-industrial middle class. Millions of these business have folded in the United States alone as people pay for services and products via what analyst Mike Lind calls “toll booth” companies like Google and Amazon who charge a fee for transactions once performed by small business owners. In the UK, “non-essential shops” were closed for weeks and forced to put their sales online. But with the ascendancy of online retailers, many have closed down. In March 2020, with turnover declining by 45 percent, the CEO of Edcon, one of Southern Africa’s largest chain retailers, broke down in front of his suppliers and told them that he only had enough liquidity left to pay his employees’ salaries. In Paris, the legendary English bookshop Shakespeare and Company begged for customers as sales slumped by 80 percent by October 2020, while the Latin Quarter’s Gibert Jeune bookstore announced its permanent closure in January 2021. In Germany, the Retail Federation (HDE) warned that 50,000 shops with 250,000 employees faced bankruptcy because of the lockdown measures.

In the US, as elsewhere, the incipient recovery has generally favored big companies, which can deploy far greater resources to make the necessary transition to a new reality. Large pharmaceutical companies have reaped lucrative profits with vaccine revenue projected to hit $26 billion by the end of 2021. In contrast, roughly 110,000 restaurants have shut down, and some 200,000 more businesses overall disappeared compared to the usual erosion. Martin Kulldorff, a professor at Harvard Medical School, summarized the impact like this: “Lockdowns have protected the laptop class of young low-risk journalists, scientists, teachers, politicians, and lawyers, while throwing children, the working class, and high-risk older people under the bus.”

Yet, as in the aftermath of past pandemics, some entrepreneurs are rising to take advantage of the disruption. In the United States, for the first time in years, there’s been a rise in startup activity at the grassroots level as well among IPOs. After years of decline, new business formations rose from roughly 3.5 million in 2019 to 4.4 million in 2020. Self-employment, pummelled at first, has recovered more rapidly than conventional salary jobs, as more Americans reinvent themselves as entrepreneurs. The market for personal services and good food did not disappear with the pandemic, the rules simply changed, with far greater emphasis on web-based facilities for selling wares. The restaurant industry is probably set for permanent change with the rise of ghost kitchens that only produce food for delivery and takeout with no dine-in area. CNBC reports that this market is set to become a trillion-dollar industry by 2030. With online meal delivery services set to grow in the Global South, ghost kitchens are projected to become more common in countries such as India and South Africa.

The biggest winners may also include companies that dominate the tangible economy, not by brokering but by producing. After all, demand for food—notably from China—as well as steel, glass, and selected minerals—notably those used for computers, solar panels, and electric vehicles—has soared. The shift of people to the suburbs and exurbs has pushed up the demand for things like wood products and concrete to high levels. The experiences with degraded supply chains—most poignantly, the reliance of Western nations on Chinese medical supplies—has sparked greater interest in manufacturing in the US, which is now expanding more rapidly than in almost four decades. This has led to a rare moment of consensus as evidenced by the nearly unanimous passage of the “Buy America Act.” Concern is most marked in medical equipment. Even as the pandemic was shutting some sectors down, growth in medical products, materials for protective barriers, and personal protective equipment (PPE) such as gowns, gloves, and masks, helped manufacturing grow by 700,000 jobs by June 2020, after hitting a decade-long low earlier in the pandemic.

For now, China and the other quasi-Confucian states in East Asia have emerged from the pandemic relatively well positioned. Although it was likely the source of the virus, China’s authoritarian controls appear to have successfully crushed its epidemic. China emerged from the pandemic first among the major countries, and its productive power does not depend on whether a sale is made by Amazon, Shopify, or a high street shop. China also retains an almost monopoly position on the EV battery supply chain, including control of 80 percent of the world’s raw material refining, 77 percent of the world’s cell capacity, and 60 percent of the world’s component manufacturing. China’s 2049 aim to dominate the supply chains and become a global superpower seems more coherent than Western governments’ vague dream of “building back better.”

The other potential winner, oddly enough, is likely to be China’s arch-rival, the United States. Early in the crisis, much of the US media—as part of its relentless attacks on the toxic Trump presidency—suggested that the country was marshalling the world’s worst pandemic response. But today the US ranks 16th in per capita fatalities, below 13 European countries. It also has among the highest vaccination rates in the world, nearing 50 percent at the time of writing (but still well behind countries like Israel), and in most places things are returning to normal. In contrast, the slow rates of vaccination in the European Union—roughly half of French citizens pledge never to vaccinate—could slow the return to normality there. And unlike most of the United States, Europe depends on such things as mass transit, which has fallen out of favor across the world, even in densely populated places such as Paris. The crisis also revealed the incompetence of the EU bureaucracy, which does not bode well for its transition to a post-COVID economy.

But perhaps the pandemic’s most consequential development has been its impact on developing countries from India to Brazil and Mexico. These countries lack the medical resources to cope with outbreaks and suffer low vaccination rates, generally well under 20 percent at present. COVID denial is also a problem in some poor countries—Tanzania’s autocratic president Magufuli openly denied the COVID-19 pandemic, fired his scientific advisors, and banned the import of test kits he called a form of “Western imperialism,” before he contracted the disease which then killed him. Even in more democratic countries such as South Africa, corruption was allowed to run out of control. Money allocated for pandemic relief went missing from the state coffers, and large state tenders were dished out to government cronies for medical equipment that was never delivered, leaving medical workers to fend for themselves.

Global vaccine inequality may prove decisive—only one percent of global vaccine supplies have thus far been distributed to African countries, the emerging demographic giant of the future. Most of these countries lack the medical and financial resources to cope with the pandemic, and are depending on Chinese and Russian vaccines, which appear to be less effective than the Western alternatives. Some countries have been devastated by the loss of tourism. Americans are asked not to travel to 80 percent of the world, which has had a devastating effect on the Caribbean Islands, East Africa, and parts of Southeast Asia. One cannot expect tourists to rush to places where images of unburied corpses dominate the nightly news, and some of these countries could remain off-limits for months or even years.

Prospects may be better for those countries with the richest resources, particularly those with minerals like cobalt, lithium, and manganese that power the batteries essential to the digital and green economies. Yet a dependence on commodities also threatens a return to the old colonial patterns of resource dependency, with China increasingly replacing Europe and the United States as the supplier of goods and sophisticated services. The International Monetary Fund envisions “a great divergence” post-COVID between developed economies, including China, and the developing economies. Without a transition to a less resource-based economy, Africa will continue to generate vast “reserve armies of the unemployed” (to paraphrase Karl Marx) at destabilizing levels. The unemployment rate in South Africa rose to 32.5 percent during the pandemic, and almost two-thirds of the youth have been left with no job in sight. The story is unfortunately similar in regional powers such as Kenya and Senegal which are reporting over 40 percent unemployment. This is a recipe for chaos. Several Latin American, African, and Middle Eastern countries also have defaulted on long-term loans, and more may follow.

The future in the wake of the pandemic, at least in the higher income countries, may still prove brighter than might be expected. Although many older businesses may never return, new companies have arisen in everything from manufacturing to retail and high-end services, including restaurants. Demand for labor and products are growing across the board, providing new demand for upstart companies and new workers. This is very different to what occurred in the Great Recession, which hammered startup rates and reduced job openings. The new paradigm has been shaped by demographic shifts caused by lower birth rates; US population growth between 16 and 64 has dropped from 20 percent in the 1980s to less than five percent during the last decade.

These trends were evident before the pandemic; working-class Americans were making significant income gains for the first time in a generation. Now, with 7.4 million openings, even restaurants are being forced to hand out “signing bonuses,” as workers remain on the sidelines. With the labor force down eight million over the past year in the US alone, wage pressure is growing. Economists may hate labor shortages for raising business costs but the pandemic could help ameliorate the growing inequality in advanced countries. The most significant opportunities appear to be in skilled trades and in production, but also in higher end service and tech positions. The shift to online work means opportunities are becoming available in long-marginalized but low-cost locales. Some American cities, such as Tucson and Tulsa, offer upwards of $10,000 annually for relocating remote workers.

Equally critical, the resurgent manufacturing, logistics, and home-building has raised the prospects for skilled workers, or even for those who are simply willing to acquire skills and work hard. In 2019, for the first time in a decade, the percentage of US manufacturing goods that were imported dropped, notes a recent Kearny study, with much of the shift coming from East Asia. Labor shortages have emerged in critical industries, from manufacturing to trucking and construction. With manufacturing employment expanding more rapidly than in almost four decades, job openings for the industrial sector are up 75 percent since last February.

Over the next few years, the pandemic may benefit contemporary workers in ways roughly akin to how the far more deadly Medieval European plague benefitted workers and entrepreneurs who somehow survived that contagion. Jobs have been surging in both the manufacturing sector and the logistics industry, which is great news for large companies like United Parcel Service, DHL, and Federal Express, but also for smaller suppliers. The shortages of drivers and independent contractors have become so severe that Amazon has set up its own incubator for new trucking companies.

Taking advantage of the post-pandemic era may start with securing national health but will depend over time on creating better conditions for adaptive grassroots businesses. Like past disruptions, COVID-19 has reinforced some very dangerous trends, notably corporate concentration and expanded poverty, but has also created opportunities for the rise of new and better ways to do business. Things will never go back to the way they were, but whether they get better or worse depends on what we have learned, and how we respond to the pandemic and its economic consequences.

References

1 Marie Favereau, The Horde: How the Mongols Changed the World, (Cambridge, MA: Belknap Press, 2021), pp.353–365

2 Barbara Tuchman, A Distant Mirror: The Calamitous 14th Century, (New York: Knopf, 1978), p.276, 386, 365–7