Top Stories

Tyler Cowen's Stubborn Attachments—A Review

In a cultural landscape where partisan skirmishes regularly induce something approaching bloodlust on both sides of the political aisle, it’s safe to say that most Americans are roundly rejecting Cowen’s thesis at the moment.

A review of Stubborn Attachments: A Vision for a Society of Free, Prosperous, and Responsible Individuals by Tyler Cowen. Stripe Press (October 2018), 160 pages.

The complexity of the modern world makes it difficult to know what’s worth caring about. We all know that many problems exist, but none of us know for certain which problems are over-exaggerated, which ones are under-exaggerated, which ones admit of solutions, and which ones would only be exacerbated by our meddling. To make matters worse, the increasing partisanship of mainstream media along with the echo chamber effects of social media throws doubt on the notion that information reaches our minds free of slant, spin, or skew.

Onto this landscape of paralyzing uncertainty strides the economist Tyler Cowen with a bold solution. As he argues in his new book Stubborn Attachments, there is one goal we should promote above all else: maximizing the sustainable rate of economic growth. Of course, you’re free to care about other societal issues if it makes you happy. But from the point of view of increasing human well-being, Cowen argues, you can’t do better than maximizing growth; indeed you can’t even come close.

Cowen’s argument has three premises. The first is that wealth is the best thing humans have ever created. If you enjoy living past thirty, not starving to death, not having to wash clothes by hand, talking to loved ones on the phone, air conditioning, and having free time to read articles like this one, then you have the existence of wealth—or rather the people, institutions, and ideas that create it—to thank.

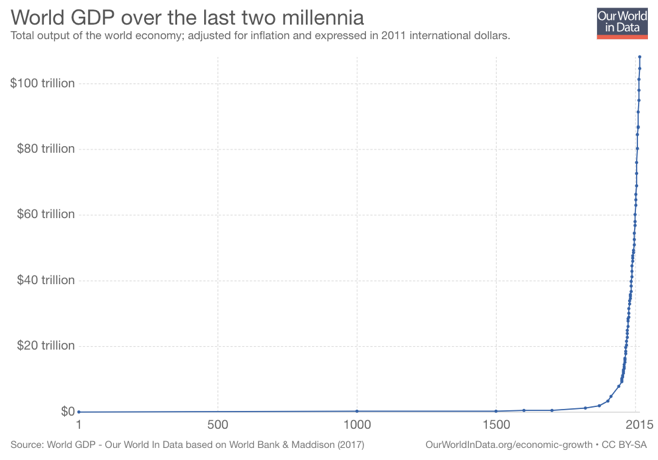

To be sure, there’s more to human flourishing than just wealth. We also care about things like justice, human rights, and emotional fulfillment. But even values like these, which seem to be unrelated to wealth, still ride on its coattails. As Steven Pinker points out in Enlightenment Now, gross domestic product (GDP) “correlates with every indicator of human flourishing” including longevity, health, nutrition, peace, freedom, human rights, tolerance, and even self-reported happiness levels.1

Cowen’s second premise points to the surprising implications of exponential growth. Put $2 on the first square of an 8-by-8 chessboard, $4 on the second square, $8 on the third square, etc., and there will be more dollar bills on the final square than there are blades of grass on planet earth. Now replace squares on a chessboard with years on a timeline, and replace dollar bills with units of “wealth plus” (Cowen’s term for GDP plus immeasurable goods like leisure time and environmental amenities), and just like dollar bills accrue with shocking speed on a chessboard, “wealth plus” accrues with shocking speed over time.

The difference between the chessboard and global wealth is that, unlike the predictable doubling of dollar bills on each square of the chessboard, the economic growth rate changes every year based to a large extent on policy decisions. A slightly higher rate of growth than we have now—say, one extra percentage point per year—may not matter much in the short-term, but in the long-term, exponential growth makes that single percentage point hugely important.

Cowen gives a hypothetical example: “redo U.S. history, but assume the country’s economy had grown one percentage point less each year between 1870 and 1990. In that scenario, the United States of 1990 would be no richer than the Mexico of 1990.”2 That would mean hundreds of millions of people working longer hours and receiving a lower standard of living in return. On the other hand, if we imagine that the growth rate were one percentage point higher during those years, Americans would be far wealthier than we currently are. “Production could be much greater than it is today,” Cowen maintains, “and our lives could be more splendid.”3

Cowen’s final premise is what he calls “Deep Concern for the Distant Future.” This means that, in a utilitarian calculus, we should not devalue people just because they don’t exist yet. When it comes to money, we all devalue the future. Having a dollar today is worth more to us than having a dollar in a year, which is why banks can charge interest on loans. But if we treated morality like we treat finance—by imposing a “moral interest rate” of, say, 1.4 percent—then a single death today would equal (in utilitarian terms) about one thousand deaths in the year 2518.

Taken to the extreme, devaluing the future in this way would commit us to absurd conclusions like the scenario imagined by Cowen and the late philosopher Derek Parfit: “Imagine finding out that you, having just reached your twenty-first birthday, must soon die of cancer because one evening Cleopatra wanted an extra helping of dessert.”4

The idea that a future life should be worth the same as a present life seems innocent enough. But combine it with Cowen’s other premises and you reach a stunning conclusion: (1) If wealth-plus is the largest driver of human well-being; and (2) if small changes in the current growth rate will lead to huge differences in the amount of global wealth-plus many years from now; and (3) if future people (who will vastly outnumber present people) are just as valuable as you and me; then the most important thing we can possibly do is maximize the sustainable rate of growth so that the majority of humankind—namely those yet-to-be-born—will have much more wealth-plus than they’ll have if we continue chugging along with our current, middling rate of growth.

It’s hard to find an error in Cowen’s argumentative chain. Nevertheless, for many the idea of orienting public policy primarily towards wealth maximization will conjure up images of a soulless, hyper-capitalistic hellscape where humans are treated as dispensable labor-machines. Cowen, however, anticipates this objection by placing one major constraint on growth-maximization: human rights. Under no (realistic) circumstances should we violate human rights to maximize the sustainable rate of growth, he maintains; but, short of that, Cowen believes we should stop at nothing.

At 110 pages in length (minus appendices), Stubborn Attachments makes a careful case without wasting the reader’s time. The discussion of human rights, however, does suffer for its lack of detail. For a start, Cowen doesn’t define the concept of a “right,” which presents a problem given that it’s prone to infinite expansion. Things which didn’t even exist a few decades ago—the internet, for instance—are now seen as universal human rights. If treading on human rights is the one thing we cannot do to increase growth then, in practice, the list of proscribed policies may grow ever longer as humanity invents nice new things and dubs them “rights.” Vis-á-vis humanity, the conceptual expansion of rights is a sign of moral and economic progress. But vis-á-vis Cowen’s argument, it’s a weakness.

Even with a well-defined human rights proviso, Cowen’s thesis might still leave the typical reader somewhat cold. This gut-level discomfort, however, is just an artifact of the mismatch between our apish programming and our modern context. Our common sense intuitions about good and evil were shaped in a context where the nicest thing you could possibly do was share a gazelle you just killed with your tribe. It’s no wonder, then, that our moral itches aren’t scratched by phenomena as recent in our evolutionary history as market competition and incentive structures—even if those phenomena are the deepest drivers of human well-being.

Others may worry that most of the gains achieved by maximizing growth will go to the rich. Since 1980, the share of national income going to the highest tax brackets has skyrocketed, a trend which shows no sign of stopping. If further economic gains will be hoarded by the ultra-wealthy, then the focus on growth is misplaced. Instead, we should focus on fighting income inequality by redistributing what already exists.

Cowen rejects this argument for a few reasons. First, contrary to the idea that “trickle down” economics never works, wealth actually does “trickle down” in the long-run. If it did not, he argues, then poverty in wealthy countries would resemble poverty in poor countries, because wealth at the top would never have made its way to the bottom. But the opposite is true. For instance, nearly all Americans below the poverty-line own a color TV, and over 80 percent have an air conditioner, a video recorder, and a cell phone.5 In less wealthy countries, by comparison, the poor have few or none of these things.

What’s more, when poverty is measured by the real-life goods and services people purchase rather than by the figures that appear on their paychecks, the proportion of Americans who are poor has declined 90 percent since 1960.6 Even if income hasn’t been trickling down in recent decades, better living standards—i.e., what income buys and what really matters—have.

Not only does wealth “trickle down” nationally, but it also does so globally. According to the World Bank, the global extreme poverty rate fell from 36 percent in 1990 to 10 percent in 2015, lifting over a billion people out of officially-defined destitution. This economic miracle was not caused by charitable donation or top-down redistribution, but by the expansion of market economies into the developing world. (That’s not to say Cowen is against charity. To the contrary, all of Cowen’s earnings from Stubborn Attachments will go to an Ethiopian man pseudonymously named “Yonas.”) Indeed, part of the reason income inequality has increased within developed nations is because it has decreased between nations, due to increased competition from the rising global middle class. In short, it’s not true that the gains achieved from a higher growth rate would mainly line the pockets of the ultra-rich.

The second reason Cowen rejects the inequality critique is that redistributionist policies, though often sold as straightforward solutions to poverty, often require tradeoffs—that is, they might reduce poverty for some while preventing others from escaping it. Consider the contest between reducing poverty for Americans and reducing poverty for migrants: the bigger America’s welfare state becomes, the more voters will feel (rightly or wrongly) that recent immigrants are taking more from the country than they’re contributing. Thus, they will vote to curb immigration, preventing many migrants from achieving a higher standard of living by moving to America.

Cowen also highlights the tradeoff between current poverty and future poverty. Imagine that we institute some policy intended to help the poor—say, a new entitlement program funded by a tax increase. Imagine, moreover, that this new policy has the unfortunate side effect of slightly reducing the economic growth rate. What we will have done, in effect, is prioritize some number of today’s poor over a far greater number of tomorrow’s poor. This is because a slightly lower growth rate today means much less national and global wealth-plus hundreds of years from now, which in turn means billions (upon billions, upon billions…) of future people who will be much poorer than they could be.

That said, Cowen doesn’t reject redistribution per se; he is strongly in favor of redistributionist policies that increase growth, like ensuring that the poor are well-housed and well-fed. He only rejects forms of redistribution that reduce growth. The unconditional desire to reduce inequality, growth-be-damned, is “the thinking man’s equivalent of the savage’s short-run gratification,” Cowen writes. “It is our latest adaptive mechanism for feeling good about ourselves, at the expense of letting Rome burn.”7

There is something in Stubborn Attachments for all three major political ideologies—and therefore something for ideologues of each stripe to hate. Conservatives will love Cowen’s appreciation of order and stability (burning the system to the ground is bad for growth), but some will bristle at his deep concern for the implications of climate change. Libertarians will love the emphasis on markets but will hate Cowen’s defense of the welfare state. And progressives will love Cowen’s stances on climate change and human rights but will balk at the idea that capitalism, far from being a scourge on the poor, is in fact the best anti-poverty program ever devised.

Ultimately, absorbing the thesis of Stubborn Attachments would entail a radical loss of purpose for the politically-minded among us. The small, short-term policy fights that energize us most are precisely the ones from which, on Cowen’s account, we should abstain entirely. Even the smartest among us don’t know what net effect small policies will have; plus very little well-being turns on such policies to begin with. Growth maximization, on Cowen’s view, becomes a moral black hole from which no partisan skirmish, no matter how seemingly important, can escape.

In a cultural landscape where partisan skirmishes regularly induce something approaching bloodlust on both sides of the political aisle, it’s safe to say that most Americans are roundly rejecting Cowen’s thesis at the moment. But perhaps that means the message of Stubborn Attachments is needed now more than ever.

References:

1 Steven Pinker, Enlightenment Now, (Viking: New York), 96.

2 Tyler Cowen, Stubborn Attachments, (Stipe: San Francisco), 40.

3 Ibid., 24.

4 Ibid., 65.

5 Pinker, Enlightenment Now, 116-117.

6 Ibid., 117.

7 Cowen, Stubborn Attachments, 124.