recent

The Economic Illiteracy of Alexandria Ocasio-Cortez

It is hard to emphasize how chillingly inept this remark is, especially for someone with a degree in economics.

In a recent interview with Rolling Stone, newly elected Congresswoman Alexandria Ocasio-Cortez was compared to Donald Trump in her “ability to galvanize [her] supporters through social media.” To this she replied: “In order to resonate with people, you have to tell them what you mean, you have to be willing to make mistakes, you have to be willing to be vulnerable and learn as you go.”

Ocasio-Cortez has indeed garnered a lot of attention since upsetting Joe Crowley in the race to represent New York’s 14th district in the U.S. House of Representatives last year. With over 3.5 million followers on Twitter, an initialism (AOC) that has caught on with cable news, and an audacious personality, she has become a vociferous presence in the contemporary social discourse—particularly on issues like race, taxes, health care, Amazon, economic inequality, and climate change.

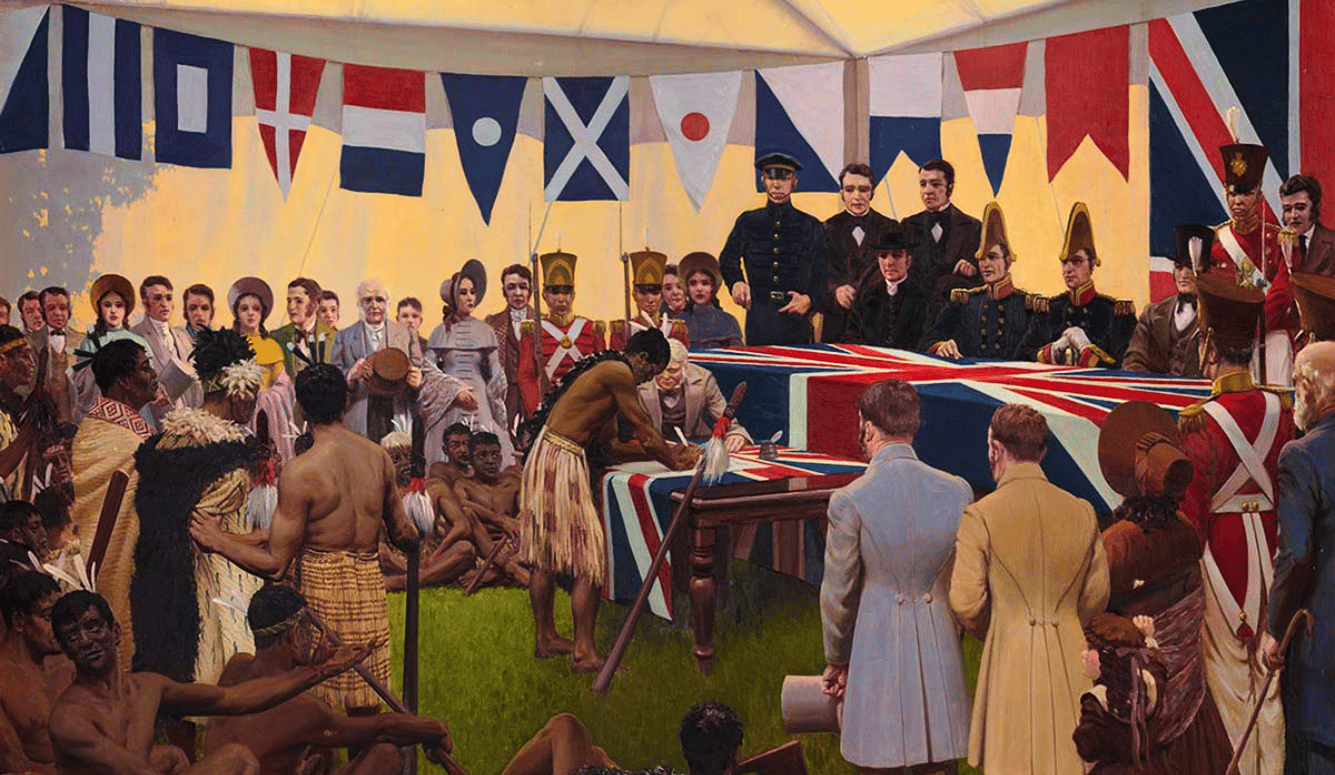

In the latest example, AOC sparked controversy when she took former U.S. President Ronald Reagan to task, as related by Huffington Post, by bringing up “one of [his] favorite anecdotes from his 1976 presidential primary campaign…about a Chicago woman who was accused of fraudulently collecting public benefits under a variety of names.” AOC remarked: “So you think about this image, ‘welfare queens’…and what [Reagan] was really trying to talk about… He’s painting this really resentful vision of essentially black women who were doing nothing, [who] were sucks on our country, right? … That’s not explicit racism, but it’s still rooted in racist caricature. It gives people a logical—a “logical”—reason to say, ‘Oh, yeah, no. Toss out the whole safety net.’”

While the remark sparked controversy because of the alleged racism implicit in Reagan’s anecdote, AOC seemed intent on blaming Reagan not for racism per se but for instigating efforts to “[t]oss out the whole safety net.” Indeed, perhaps the most common feature of her public remarks on policy matters is that they relate to economic issues, such as the role of the government in the economy. Unfortunately, however, another common feature of her public remarks is that she is alarmingly prone, not simply to making mistakes that arise from climbing the learning curve on complex policy issues, but to making reckless intellectual mistakes that should easily be avoided by someone who has gloated about having an economics degree. Rarely does an AOC remark on economic issues go by, in fact, in which she does not demonstrate an ideological impulsiveness that compromises any presumed adherence to sound economic reasoning, prompting doubts about how much she learned when she studied economics at Boston University.

To be fair, her soak the rich tax policy draws on legitimate debates among economists about the pros and cons of supply-side economics, which was a central tenet of what came to be known as Reaganomics, and whether high marginal rates on large levels of income would have severe counter-productive effects on the marginal propensity to consume (probably not). But this is a debate that has been rehashed like so much old laundry that even a lay person without a college education can understand the basics of what is at stake. More generally, there is no reason to take AOC seriously when she speaks about economics, whether about the social safety net or any other issue related to economics, even though she studied economics as a college student. The reason is that AOC repeatedly demonstrates a glaring lack of command not only of facts, but of basic economic principles.

First, her Green New Deal, which appears to be inspired by the highly-risky, nonsensical ideas of Modern Monetary Theory (MMT, which I have written about here). Instead of focusing on entitlement reform and addressing the demographics and rising health care costs which lie at the root of America’s looming debt crisis, the Green New Deal would “spend the U.S. into oblivion,” likely beyond anything that could have been imagined when President Reagan’s critics blamed his supply-side fiscal policies for increasing America’s debt load (as a percentage of GDP) during the 1980s.

Second, she demonstrated her F-grade economic literacy when tweeting about tax incentives and her opposition to Amazon’s attempt to establish offices in Long Island City. She subsequently claimed, “If we’re willing to give away $3 billion for this deal, we could invest those $3 billion in our district ourselves if we wanted to,” as if the $3 billion were a giveaway from funds already available in the tax coffers, rather than “$3 billion that would go back in tax incentives…only after we were getting the jobs and getting the revenue,” as New York City mayor Bill de Blasio (and fellow progressive) explained during an interview with NBC’s Meet the Press.

Third, in one high-profile PBS interview last year, she claimed that unemployment in America “is low because everyone has two jobs” and “people are working 60, 70, 80 hours a week.” She was subsequently chastened by Politifact, which pointed out that “[f]ewer than one in 20 employed Americans holds a second job of any type, and the people who might be working as much as 70 or 80 hours a week represent a tiny fraction of that tiny fraction.” Moreover, “[w]hen…[the government] determines the unemployment rate, a person is counted as employed as long as they have at least one job” (i.e. the U.S. government does not double-count jobs when people with multiple jobs report being employed).

It’s not just that she often gets facts wrong, or that her pie-in-the-sky idealism convinces her to take seriously MMT’s cavalier attitude about budget deficits. These can be expected from a political neophyte, and perhaps even forgiven. More astonishing is that her views garner so much attention on matters of economic significance despite how transparently her remarks make her sound as if she’s never taken an economics course.

This can best be illustrated by example, so let’s unpack a recent AOC tweet that flatly ignores basic economic principles. Earlier this month, she tweeted an NPR story about a study finding that Uber and Lyft drivers earn $3.37 per hour.

In the same thread, she claimed that “Uber runs at a deliberate loss to monopolize market share,” supposedly as part of “a post-profit model” (presumably, she meant “pre-profit model,” as it’s not at all clear what a “post-profit” model is). Then she made a claim that seems more akin to the obtuse central planners one finds in Ayn Rand’s dystopian world of Atlas Shrugged than to someone who has a solid grasp of economic fundamentals: “If you’re a shoe business, you don’t get to pay half price for the leather you need just because you’re not profitable. Living wage is the minimum cost of labor. Anything less is exploitation.”

It is hard to emphasize how chillingly inept this remark is, especially for someone with a degree in economics. First, although the study pertains to both Uber and Lyft drivers, she chastises Uber as an aspiring monopolist, while also failing to observe that Lyft, not Uber, was the first to file an IPO, and that, according to Lyft’s S-1 statement: “Our U.S. ridesharing market share was 39 percent in December 2018, up from 22 percent in December 2016.” This hardly qualifies Uber as a potential monopolist, and maybe not even a duopolist, considering that Uber and Lyft conceivably compete with taxicabs, buses, subways, and perhaps other forms of for-hire transportation services like shuttle buses or even Bird, though to varying degrees (a relevant market analysis would have to be conducted to delineate the precise product and geographic contours of Uber’s effective competition).

Second, a “living wage” is a worthy policy objective, but it is a lot harder to define a living wage than to summarily declare that everyone has a right to it. Not that economists have not tried. But simply asking a few questions demonstrates how hard it can be. Should a living wage be set at a level sufficient to afford basic necessities like food, shelter, and clothing? What types of groceries, and does the composition of the basket of groceries remain fixed over time? If the prices of Red Delicious apples rise, should wages rise, or should wages remain the same if consumers can buy cheaper Granny Smith apples and consider themselves equally well-off? Should it include milk? If so, what about people who are lactose-intolerant? Moreover, what constitutes sufficient shelter accommodations? How many rooms? Should a home include a dishwasher? Washer and dryer? How many pairs, and what types, of shoes or pants should be affordable with a living wage? Should a living wage include the monthly payment for an iPhone or Android smartphone simply because smartphones are so ubiquitous?

Questions abound, but the point is not to play devil’s advocate. These are not the idle questions of a gadfly, but serious questions about the composition of goods and services that constitutes an acceptable standard of living. If you think it is easy to define a standard of living, you clearly have not studied cost-of-living theory, which underlies one framework for measuring consumer price inflation. In fact, for all the talk about stagnant real wages, there is a valid argument to be made that “stagnant” real wages reflect shortcomings in the measurement of inflation rather than a decline in living standards or affordability (just thinking about being able to install an app to play chess on a smartphone, or about all the other apps available on a smartphone, should be enough to realize how much more bang for a buck one can get today compared to a few decades ago).

Equally pertinent is the fundamental economic point that a “living wage” is equivalent to a price floor. While not necessarily the same as a “minimum wage”—which is legislatively-determined and enforced by law—it is closely related in that the crucial economic matter is where this price floor stands in relation to market equilibrium. At equilibrium, the incremental revenue from hiring an additional worker is equal to the incremental cost. There is no incentive for firms to hire more workers, and there is no incentive for workers to supply more labor. In short, demand equals supply and the optimal output is supplied. Needless to say, in the real world, it is hard to figure out where that equilibrium point is. It is quite possible to observe an expansion in hiring even as authorities raise the minimum wage if, for example, the economy is growing (the demand curve shifts to the right). But if the floor is set above equilibrium, there is an excess supply of workers, which, by definition, means the wage is too high and many workers, who might otherwise be able to find work if the market were at equilibrium, will be unable to find work (see here for a concise summary of this point and a helpful graph).

One major complication is that a market equilibrium is rarely static. For example, a recent study by JP Morgan on the earnings of ride-sharing drivers concludes that “alongside the rapid growth in the number of drivers has come a steady decline in average monthly earnings.” Uber and Lyft dispute this finding, as well as the study concluding that drivers earn $3.37 per hour (the study to which AOC referred has faced such sharp criticism that “its authors say they will redo their analysis,” and other studies—by the likes of highly-touted economists like Alan Kreuger and John List, among others—have indicated that drivers earn approximately $20 per hour). Nonetheless, the idea that inter-temporal growth in the supply of drivers, all else equal, would lead to a decline in earnings is easily understood as a shift in the supply curve which results in a new equilibrium at which drivers provide more rides for lower wages (assuming that increased demand absorbs the increase in supply).

These are not merely academic points, they have real-world consequences, as anyone who has studied the history of taxicab regulation in the U.S. will understand. This report and this book provide a more comprehensive history, but suffice it to say that similar concerns about an excess supply of taxicab drivers emerged during the Great Depression of the 1930s. Unemployed workers were using their cars to earn a few extra bucks. This “ruinous competition” caused a steep decline in earnings, not to mention detrimental effects on traffic safety, convincing regulators to push for restrictions on the supply of taxicabs in cities like Boston and New York City. The subsequent half-century saw the emergence of barriers to entry which artificially increased the value of taxicab licenses, allowing a rent-seeking industry to become entrenched, at the expense of both driver earnings and consumer welfare.

No need for a deep dive into that history, but the taxicab industry offers a vivid example of the dangers presented by ill-conceived regulatory efforts that stemmed initially from reasonable concerns about driver earnings. Smart regulation can undoubtedly improve market efficiency, and a “living wage” is, in principle, a worthy goal for policymakers to pursue. But regulatory efforts and policy goals must competently take into account how markets work. Profitability depends critically on the cost of labor, which depends on demand and supply rather than arbitrary definitions (as it seems one would expect from AOC given what I have argued thus far) of a “living wage.” In the long run, if a firm is not profitable, there is no “living wage” because there is no wage at all. The firm goes out of business, and no longer demands any labor at all (and speaking of the disappearance of jobs, or prospective jobs, when firms are not there to hire people, it is thanks in part to AOC’s opposition that Amazon will not be bringing 25,000 new jobs to Long Island City, and that New York will miss out an estimated $27.5 billion in extra tax revenue).

Yes, there are all sorts of complications one can introduce into the basic framework of supply and demand. But rudimentary as it may be, it is also fundamental, and one that anyone with an economic degree should have grasped. But like much of the commentary from AOC on economics, it sounds like, at the very least, the boldness of her style matters more than the validity of her ideas. Instead of lending her credence based on her economics degree, we should be asking her to take some refresher courses. Until then, her recent comments on Reagan and the safety net should be ignored.