economics

Economics is Not a Game of Monopoly

The standard textbook model of monopoly economics only applies to the real world in a narrow range of circumstances.

In a recent panel discussion at the Institute of Art and Ideas, internationally renowned Marxist professor Slavoj Žižek accused successful entrepreneurs of having become wealthy by privatizing resources that previously belonged to all of us. "I think it is meaningful to say—although the term is maybe too radical; it's not as simple as that—that we are entering an era with new feudal masters,” the New York University Global Distinguished Professor explained:

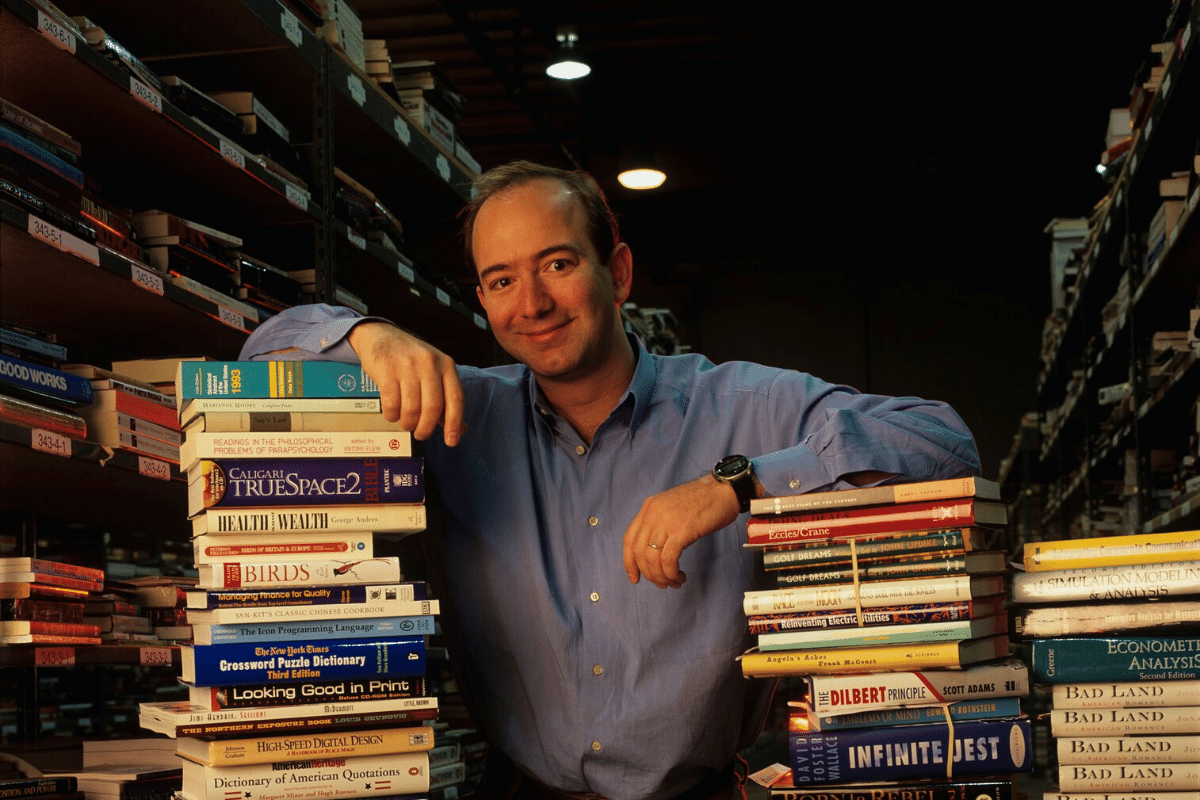

These ultra-rich corporations are owned by individuals. How did Bill Gates become so rich? He monopolized our commons. If we want to communicate, we have to go through his products. So, it's not profit in the sense of exploiting his workers. It's rent. We are paying him rent, we are paying Jeff Bezos rent, and so on, and so on.

If Žižek were correct that Gates, Bezos, and other tech billionaires built their fortunes by restricting access to pre-existing resources, rather than by generating new wealth through technological progress, then it might be worth taking radical steps to reclaim the conquered assets. But in fact, the opposite is true.

At Amazon, for example, Bezos developed innovative supply chain and logistical processes, enabling cheaper prices and faster shipping for a broader range of products than any other store in history. Bezos and his team did not attain their dominant market position by blocking public access to their myriad competitors—who include giants like Walmart, Target, and Barnes & Noble. They simply outperformed those competitors, putting many of them out of business and obliging many more to improve their own services or face the financial consequences.

Far from restricting access to our commons, Bezos and his team invented trading opportunities that previously didn’t exist, replaced the narrower and more expensive product ranges provided by their competitors, and became profitable by attracting customers who voluntarily chose their services over those of less efficient retailers.

Bill Gates, likewise, made his fortune by offering consumers access to technologies, such as the operating systems MS-DOS and Windows, that the common person had never had access to before.

Many people have accused Gates of copying Apple’s pioneering graphical user interface (GUI). He has also been accused of monopolistic practices, most notably in the landmark 1998 antitrust suit United States v. Microsoft Corp.

But these criticisms are spurious. Both Microsoft and Apple copied the GUI from Xerox PARC Labs. Gates was able to develop the product and bring it to a wider market because of his product development skills: he excelled at making technology maximally affordable and compatible with other companies’ products, thus enabling a wider range of consumers to make use of it. And far from attempting to destroy his primary competitor, Gates invested $150 million in Apple, without which cash injection the company would probably have gone out of business in the 1990s.

In 1998, Microsoft was successfully sued for allegedly attempting to crush a technologically viable competitor, Netscape, by leveraging Windows’ overwhelming market advantage. In the “Browser Wars” of the 1990s, Netscape had a first-mover advantage and enjoyed an 80 percent market share. But then Microsoft bundled their own browser, Internet Explorer, together with Windows and gave the browser away for free, while Netscape was selling their Navigator software for $49. Microsoft also made exclusivity deals incentivising other companies to use Internet Explorer instead of Navigator. The Department of Justice stepped in to save Netscape. Among other requirements, the antitrust ruling obliged Microsoft to include Netscape’s browser alongside Internet Explorer in Windows 98, “so that consumers will have a real choice.” The ruling ignored the fact that customers had always been free to choose to use Navigator with Windows—if they were willing to pay the additional $49.

A later New York Times opinion piece co-authored by one of the plaintiffs, Senator Richard Blumenthal of Connecticut comments,

Innovation surged in the newly opened markets and the United States continued to spearhead growth in the technological world. The enduring lesson of the Microsoft case was that keeping markets open can require a trustbuster’s courage to take decisive action against even a very popular monopolist.

But this ignores the fact that consumers who preferred to use Netscape could have simply boycotted Microsoft’s products until they included it. Had there been widespread consumer discontent with Microsoft’s practices, it might have led other companies to develop competing operating systems that offered more browser freedom. But there does not seem to have been any genuine, organic demand for this.

As Peter Thiel explains in his book Zero to One: Notes on Startups, or How to Build the Future, the standard textbook model of monopoly economics only applies to the real world in a narrow range of circumstances but often gets radically overapplied by regulators:

In a static world, a monopolist is just a rent collector. If you corner the market for something, you can jack up the price; others will have no choice but to buy from you. Think of the famous board game: deeds are shuffled around from player to player, but the board never changes. There’s no way to win by inventing a better kind of real estate development. The relative values of the properties are fixed for all time, so all you can do is try to buy them up.

But the world we live in is dynamic: it’s possible to invent new and better things. Creative monopolists give customers more choices by adding entirely new categories of abundance to the world. Creative monopolies aren’t just good for the rest of society; they’re powerful engines for making it better.

In late nineteenth-century America, wealthy industrialists were often referred to as “robber barons”—a term that implies that the industrialists stole their fortunes rather than creating them. But perhaps the most notorious robber baron, John D. Rockefeller, became the world’s first billionaire by creating a vast oil monopoly that provided him with the resources to invest in and distribute kerosene lamps: a radically new, safer, and more efficient indoor lighting technology. And far from charging extortionate prices for them, Rockefeller consistently kept prices low and invested profits in innovation—perhaps because he knew that if he hiked up his prices it could incentivise others to invent cheaper, alternative solutions. Yet Rockefeller’s oil monopoly was short lived: it was soon overthrown by the invention of electric lighting.

Some of the short-term thinking demonstrated by people like Senator Blumenthal can be explained by the fixed pie fallacy: the faulty belief that there is a fixed supply of wealth in any economy, and that one person’s slice of the economic pie can therefore only grow if someone else’s slice shrinks. But in fact, technological innovations, new patterns of behavior, and changes to policy can increase or decrease the overall supply of wealth, which means that one person can grow their assets without shrinking anyone else’s.

The fact that gross world product has more than doubled since 1995, and increased more than tenfold since 1950, demonstrates the absurdity of assuming that when any individual or class of people grows extremely wealthy, it must come at someone else’s expense. Rather than redistributing our commons to the wealthy, Gates, Bezos, and their employees have created new wealth for themselves by attracting consumers who conduct voluntary market transactions with them. At the same time, they have made the rest of the world wealthier by creating new opportunities for commerce and technological development. This is why, although the extremely wealthy have benefited from the world’s recent decades of rapid economic growth, the global poor have benefited even more.

Attempts to distort markets through such unimaginative measures as antitrust suits—like most attempts at economic central planning—are more likely to result in economic stagnation and political corruption than to actually benefit consumers.

As Thiel explains, “Technology is miraculous because it allows us to do more with less, ratcheting up our fundamental capabilities to a higher level.” This facilitates sustained economic growth and allows rich and poor alike to increase their standards of living in an unlimited and positive-sum way. Far from being robber barons or feudal masters, the world’s most successful technological entrepreneurs play a fundamental role in the progress that leads to greater human flourishing.