Top Stories

The Inequality Demagogues

The inequality demagogues reduce complex problems to an eternal cosmic struggle between the greedy, vampiric rich and the helpless, suffering poor.

Inequality—of wealth and income—has risen within developed nations in recent years. This has precipitated the popular ascent of the inequality demagogues. These firebrands decry a society fractured by rapacious elites, who “rig” the economy to swindle the helpless masses. In 2015, Bernie Sanders, then a contender for the Democratic presidential candidacy, invited his supporters to join him in a “political revolution” against the “one percent,” whose “greed,” he blamed for “destroying our economy.”

Inflammatory rhetoric like this resonates with people and can be remarkably successful in generating furious outrage. This is because large disparities in wealth and income are an affront to intuitive notions of fairness, and if a politician insists those disparities can be painlessly eliminated by the mere exercise of political will, they also seem unnecessary. It doesn’t help that many of the wealthiest have capitalized on their relative power through dubious (though usually legal) means. They attain lower tax rates by exploiting tax loopholes, or by manipulating income in order to benefit from the lower capital gains rate. Similar tactics are adopted by companies. For example, some of Apple’s subsidiaries paid an effective tax rate of only 0.005% in 2014.

These are serious problems. However, framing them as inequality issues, as the inequality demagogues do, is misguided and produces policies that treat the symptoms of the malady, and not the cause itself. The panacea they offer is the promise of secure and lucrative employment for all. This will be delivered by a three-pronged economic strategy known as ‘Boost, Protect, and Generate’ (BPG); boost wages, protect jobs from foreign competition, and generate new ones. But this apparently commonsensical approach can have grave repercussions for three reasons.

First, mandating high pay (the ‘Boost’ part) can result in more unemployment, as employers find they can no longer afford to pay their workforce. This claim is a matter of genuine debate among economists. But Sanders’s proposals to more than double the federal minimum wage from $7.25 to $15, in spite of America’s widely variant economic landscape, would almost certainly create more problems than it is intended to solve. States with low costs of living and small businesses would likely struggle to meet wage demands, which would produce more widespread unemployment among the poor.

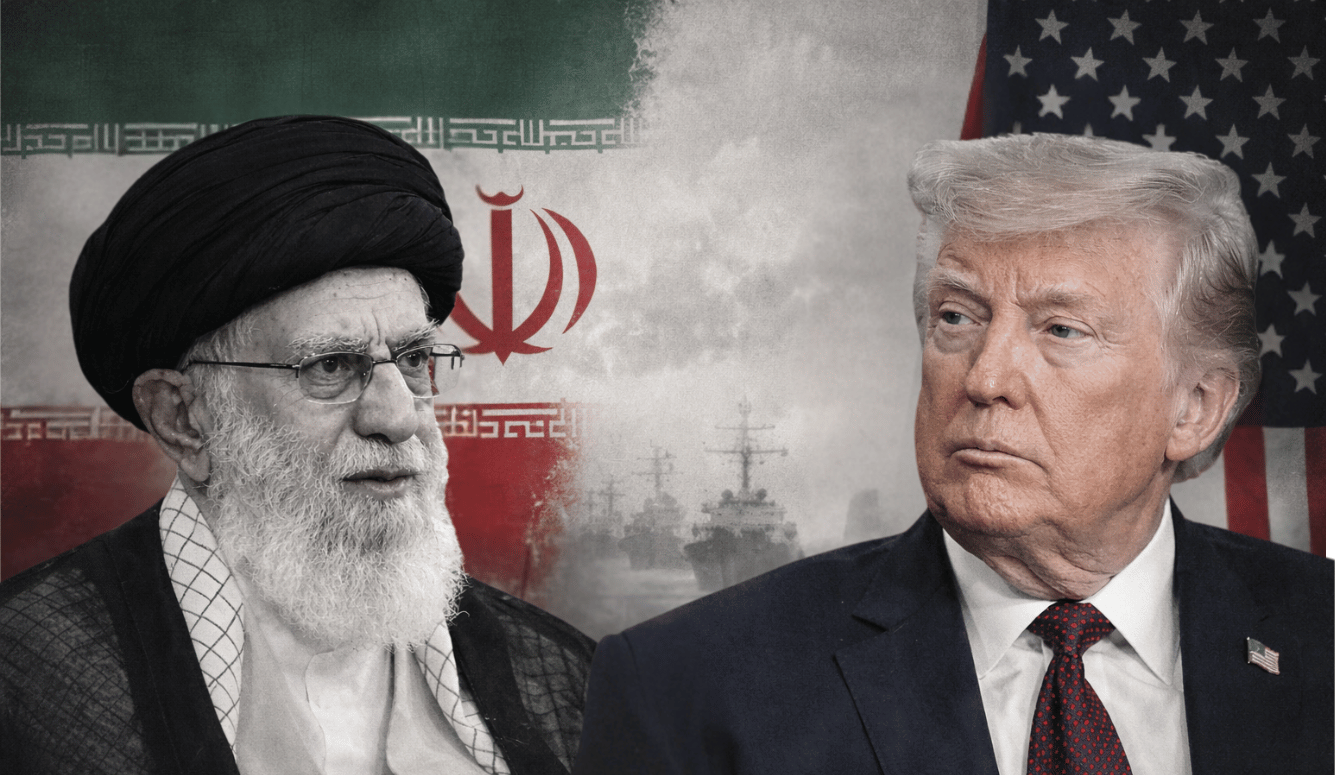

Second, protecting American jobs from foreign competition usually entails an ideological opposition to free trade. Like Donald Trump, Sanders has championed reneging on the North American Free Trade Agreement (NAFTA) and other trade agreements, which he characterises as deals signed by and for the benefit of ‘elites’ at the expense of the working class. In the same way, Jeremy Corbyn, the leader of the UK Labour party, has denounced the Transatlantic Trade and Investment Partnership (TTIP), a free trade agreement between the EU and America. And, last year, President Trump revoked the Trans-Pacific Partnership (TPP) by executive order. These self-defeating strategies may be popular but they damage the economy and the interests of those they are ostensibly intended to benefit. Protectionism does not create jobs. On the contrary, an analysis by the Trade Partnership consultancy predicts that increases in the price of steel and aluminum under the recent tariffs imposed by Trump will, in the short term, create 33,000 metal-making jobs and destroy 179,000 metal-dependent ones. This is because many more jobs rely on trade than are threatened by it. Even if some jobs are revived they are unlikely to survive in the long term. Moreover, the TTIP trade deal was supposed to build a Western free trade bulwark against China to prevent further exploitation not facilitate it.

Third, the ‘Generate’ part of BPG requires investment schemes. These are not necessarily a problem, but the means of raising and providing the necessary funds usually are. Jeremy Corbyn, for instance, has suggested that the Bank of England should print money for “new large scale housing, energy, transport and digital projects” in a scheme he calls the “People’s Quantitative Easing.” However, critics point out that Corbyn’s proposed policy risks triggering higher inflation, with the poorest households paying the price when their savings are eroded. Others also balk at Corbyn’s claims that £120bn could be recovered from tax avoidance and evasion, as companies seek new ways to avail themselves of tax havens. Instead of encouraging efficient private investment, which comes at no cost to the state, he wants to pay for public spending through sharp corporate tax increases, which will only encourage businesses to leave and set up elsewhere.

The greater problem with all this is that inequality demagogy is premised upon a misunderstanding of how wealth is created and distributed. The apocryphal story we are used to hearing is one in which, as Bernie Sanders is fond of repeating, the “rich get richer; everyone else gets poorer.” This kind of zero-sum thinking is a characteristic of the ‘lump fallacy,’ which Steven Pinker, the Harvard cognitive psychologist, describes in his new book Enlightenment Now as “the mindset in which wealth is a finite resource […] so that if some people end up with more, others must have less.” Pinker reminds us that, although the poorer half of the population still have the same percentage of the total wealth that they had in 1910—five percent—that wealth is vastly greater now. A 2011 estimate by Measuring Worth showed a seventeen-fold increase in real GDP per capita between 1871 and 2009.

That the share of increased income is more unequally distributed than it was in, say, 1996 does not mean that the poor have become poorer. On the contrary, over the proceeding decade, the percentage of U.S. households making under $75,000 (inflation-adjusted) fell by 11.5 percent. In other words, 11.5 percent more US households receive $75,000 or more in annual income. This figure accounts for increases in divorces and working children moving back home by using individual tax data, following primary and secondary taxpayers separately, and excluding those under twenty-five. The progress does not end there. Capitalism has succeeded in producing new, better, and cheaper products. The results range from life-saving drugs for under $10 to affordable and ubiquitous smartphones and free online education and tutoring. These developments benefit everyone immensely, and help to enhance social mobility. This contradicts another misconception—that the same group of people are condemned to languish eternally in poverty. In fact, between 1996 and 2005 around half of American households in the bottom 20 percent had moved out of the bottom quintile in income. The same trend has occurred in the 1970s, 1980s, and 1990s.

You may wonder whether others lose out as a result. Indeed, some drop down the income rankings. This is known as downward mobility and can be harmful to a society. However, those moving in the opposite direction are often in the upper quintiles of income. The percentage of households who drop into lower income quintiles increases for each jump in quintile. This partly explains why nearly 60 percent of taxpayers in the top one percent in 1996 had dropped out of the top one percent by 2005. Further, more than half of Americans will spend at least one working year among the top ten percent of income earners. The reason for this is that at these high levels there is a greater chance for incomes to drop or be passed out by rising ones. Thus, those afflicted by this countervailing force as those best able to withstand it. Moreover, when measured in income brackets (rather than income rankings), the effect is weak, suggesting they are not in danger of losing everything.

The conclusion here is that, the poor are, in fact, getting richer, so the implication that the opulent are somehow plundering the coffers of the penurious is simply false. The successful corporations despised by inequality demagogues positively add to our societies. They produce products that people want, they generate jobs, and they pay considerable amounts of tax. Yes, it is true that some avoid and others evade doing so, but overall the top one percent of income earners contribute nearly 40 percent of the total income tax revenues, while the bottom half pay less than three percent. This revenue largely funds social spending, which is often excluded from measures of wealth and income distribution, even though it is a massive source of income for the impoverished. Due to public social spending (as well as employer-funded social spending and the development of new products), the poverty rate in America has fallen by 75 percent over the last 50 years. In other words, a welfare system mainly funded by the wealthy has been instrumental in improving the lives of the destitute.

Inequality is growing. But the fate of the poor matters more. And the condition of the worst-off—both in Western societies and worldwide—has improved tremendously over the past half-century. That is not to say that real problems do not remain. Automation is a possible harbinger of great economic turmoil and upheaval as it becomes increasingly difficult to find jobs for people to do. And reasonable people will continue to debate ways in which the most excessive economic disparities might be mitigated so that created wealth is more fairly distributed. Addressing such questions will require a panoply of intricate strategies. There is no panacea, and populist approaches like ‘BPG’ will almost certainly do more harm than good, even as they enthuse rally crowds filled with the people they promise to help.

The inequality demagogues reduce complex problems to an eternal cosmic struggle between the greedy, vampiric rich and the helpless, suffering poor. Their followers should be wary of insurrectionary slogans and the economic snake oil they peddle. Their crude outlook is not only inaccurate, it is pernicious. Along with the postmodern denial of demonstrable progress, it encourages suspicion that the ‘system’ is fundamentally corrupt, which in turn stokes conspiracism, division, resentment, and paranoia. Unemployment; wasteful public expenditure; low private investment due to high public debt and taxation; economic decline; a self-perpetuating dearth of innovation—these are not problems easily solved once created. As a society, we must divert our focus from attaining complete equality to ameliorating the very real plight of the poor. This way we can promote the adoption of nuanced, effective responses rather than propping up unprofitable work. Only then can we enhance living standards.