Politics

A Tariff Time-Bomb

A critical part of the One Big Beautiful Bill’s budget equation may evaporate with a judicial pen stroke in the very near future.

President Donald Trump secured the first major legislative victory of his term with the adoption of the “One Big Beautiful Bill” Act, a multi-trillion-dollar spending package intended to codify his budgetary priorities. The measure contained a small victory for American taxpayers by forestalling the expiration of a 2018 income-tax cut this year. At the same time, fiscal hawks had much to criticise about the exorbitant new spending provisions, which are projected to accrue at least US$3 trillion in additional budget deficits over the next decade. The bill also contain a US$5 trillion increase in the national debt limit, removing a legislative constraint on government borrowing and setting the US national debt on track for an expansion to over US$41 trillion.

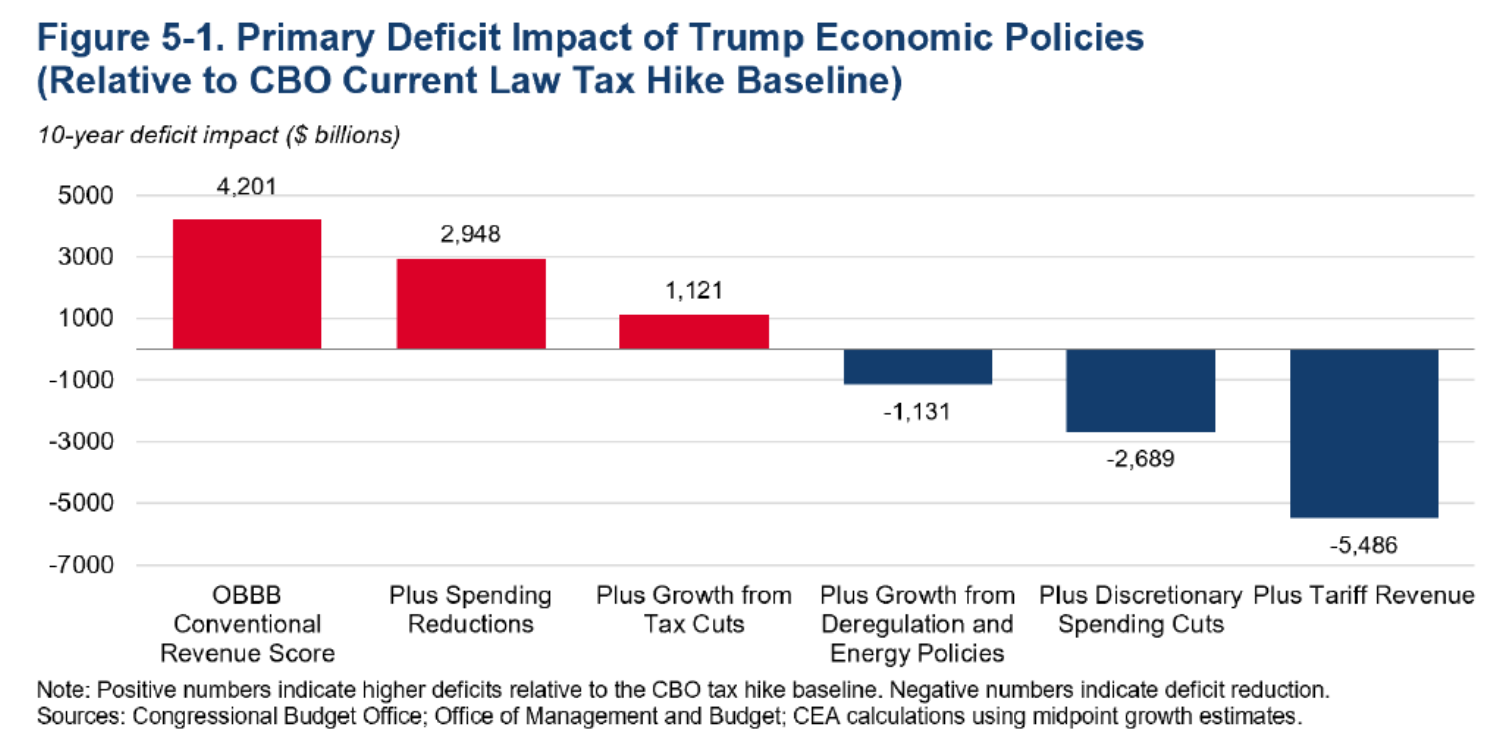

The One Big Beautiful Bill’s supporters portray the measure’s income tax cuts as a boon for economic growth, while its detractors worry about the profligate spending that is set to commence, including over US$160 billion in border and immigration enforcement funding along with the usual flurry of legislative pork. However, the One Big Beautiful Bill faces another obstacle on the horizon in the form of a ticking time bomb of tariffs. When preparing its budget calculations for the measure, Trump’s economic team relied on a new revenue source to offset its spending extravaganzas. The Council of Economic Advisors expects at least US$2.8 trillion in new tax receipts over the next decade from the tariffs the administration has been imposing on international trade with the rest of the world since the infamous “Liberation Day” press conference back in April.

The White House has been quick to tout tariff revenue as the centrepiece of its plan to pay for its spending priorities. Just last week, Treasury Secretary Scott Bessent announced in a cabinet meeting that he expects tariffs to generate US$300 billion in new tax revenue in 2025 alone. White House talking points have suggested that future tariffs will exceed even their already optimistic revenue projections in the years that follow, reversing Bessent’s widely mocked claim from a month ago that “tariffs are not taxes.” As it stands now, new tariff revenue comprises the single largest source of deficit offsets in the White House’s ten-year budget projections, far exceeding any discretionary spending reductions.

Staking so much of the One Big Beautiful Bill’s budget equation on tariffs is a risky proposition. There’s a good chance that the Trump administration’s tariff revenue stream will evaporate with a judicial pen stroke in the very near future.