book review

In an Age of Scams, Self-Help Falls Short

An individualistic focus only goes so far in preventing scams and frauds.

A review of Nobody’s Fool: Why We Get Taken In and What We Can Do About It by Daniel Simons and Christopher Chabris, 336 pages, Basic Books (July 2023).

We are, according to a number of recent commentators, in a golden age of grift. Pyramid schemes are on the rise. Scammers are raking it in like never before. Shameless promotion of nonsensical cryptocurrency, NFT, and “Web3” projects is impossible to avoid. Social media is awash with fake news, and legacy media is mired in a legitimacy crisis of its own making. Scientific and academic research can’t be trusted uncritically due to the influence of partisan and ideological forces from both the left and the right. There is a pervasive sense, especially among young people, that everything is a scam, everything is bullshit.

In their recent book, Nobody’s Fool, psychologists Daniel Simons and Christopher Chabris employ the tools and insights of their field to help us navigate a world rife with deception. They contend that “all successful deceptions exploit features of human thinking and reasoning that normally serve us well.” The first half of the book introduces four cognitive habits that leave us susceptible to deception. The term habits is perhaps misleading to laypeople. The authors are pointing to innate cognitive processes, such as our ability to focus intently, make predictions, and think heuristically, that allow us to process information efficiently.

These processes are not foolproof. Our capacity for focus is limited, our intuitions sometimes rooted in faulty assumptions, and our heuristic thinking at times simply lazy. While intensely focusing on one thing, we may miss something else crucial or obvious. The authors previously demonstrated this phenomenon in an experiment involving the unexpected appearance of a man in a gorilla suit that went viral online, which served as the foundation of their previous book on selective attention. They now draw on similar social science research to show how faulty expectations, assumptions, and mental shortcuts are exploited by those who would trick or mislead us.

Though the authors don’t offer an exhaustive compendium of scams, the book is nonetheless most compelling when pairing research with illustrative stories of fraud and deception. Simons and Chabris offer a quick survey of classic Ponzi schemes, as well as more contemporary frauds, including Theranos, the Fyre Festival, cryptocurrency scams, and more. They describe fabrication and forgery in journalism, academia, scientific research, and the artworld, as well as various deceptions perpetrated by unscrupulous advertisers, propagandists, online scammers, and more.

The second half of the book examines “hooks,” or features of newly encountered information, that can “snag our interest and bias us toward accepting claims without checking them.” For example, false or misleading claims are less likely to arouse suspicion when they conform to our expectations. On the other hand, bold or surprising claims attract attention regardless of merit precisely because they defy expectations. (Writers such as Malcolm Gladwell have built whole careers from this kind of sensationalist sleight of hand.) In other words, bad actors play on our bias toward familiarity and attraction to exaggeration to gain our trust and attention, respectively. Similarly, the human tendency to conflate precision or detail of information with its veracity can be used to fool us (i.e., a detailed alibi is often more believable but not necessarily anymore true.) And so on and so forth—the authors describe many permutations of these hooks.

To avoid being deceived, Simons and Chabris advise us to pay more attention to our cognitive habits and attempts to exploit them. Mind your biases and blind spots. Question your assumptions. Learn to recognize the telltale signs of forgery, fakery, and other deceptions. Perform “blunder checks” on your own thinking. They offer cursory lessons in logical reasoning and best scientific practices to help spot claims built on faulty arguments or flawed evidence, as well as analytical tools for evaluating claims, such as a “possibility grid” for identifying missing information that calls to mind the “Rumsfeld Matrix” inspired by Donald Rumsfeld’s infamous “unknown unknowns” comment.

In short, they encourage readers to: “Accept less, check more.” Trust, but verify.

Such advice is sound, if rather obvious, but places the onus of mitigating and avoiding fraud and deception entirely on the individual. In a society in which grift is not just rampant but normalized, such a purely therapeutic approach feels insufficient for dealing with a widespread social ill.

In the United States especially, grifting is part of the national character and ethos. Forget, for a moment, trying to avoid running afoul of scams. When everything feels like a scam, how does one avoid complicity?

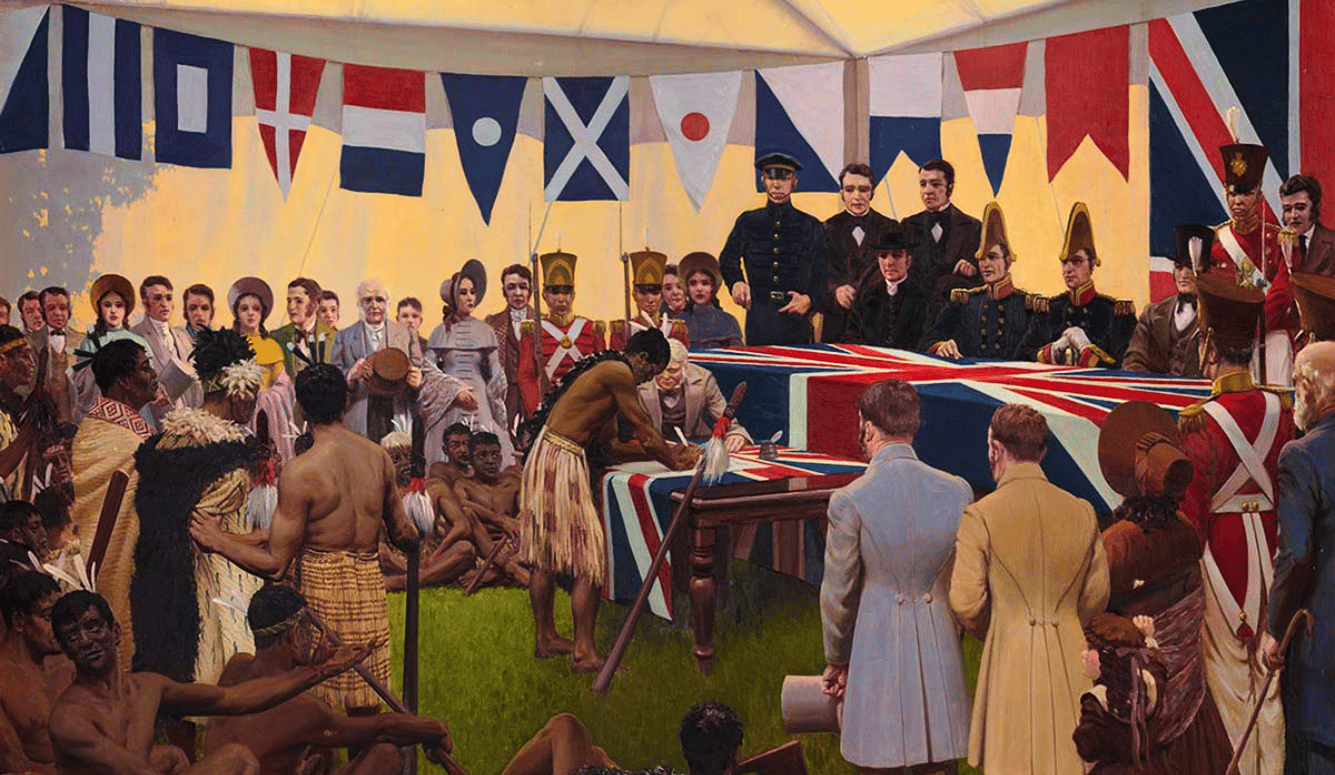

Jia Tolentino makes this point in her essay “The Story of a Generation in Seven Scams,” from the 2019 collection, Trick Mirror. Her catalogue of scams includes not just what she calls “the really obvious ones”—the kind of classic frauds and scams that concern Simons and Chabris—but also the “world of borderline or inadvertent or near-invisible scamming.” Her critique of scammer culture indicts far more than just your bog-standard conman. She also points to the bankers, lenders, and financial regulators who created the subprime mortgage crisis that precipitated the 2007-2008 financial crisis, as well as the lobbyists, politicians and regulators responsible for the taxpayer-funded bank bailouts that followed in its wake, of whom few faced meaningful consequences. She implicates Silicon Valley and big tech “disruptors,” with their perverse and deceptive business practices, as well as our own embrace of hustle culture as promoted by online influencers. She points to the criminal and deceptive deeds of the Trump campaign and administration, the proliferation and dissemination of fake news, and the entire system of neoliberal capitalism in which we all must make lives for ourselves by tooth and by nail, or by grift if need be. “It would be better, of course, to do things morally. But who these days has the ability or the time?” Tolentino muses. She is reformulating, more or less, the old refrain that there is no ethical consumption under capitalism.

Many will quibble with some of Tolentino’s points, political biases, and blinders. She is highly partisan, spending pages excoriating Trump without making specific mention of the role Democrats played in the bailouts and the neoliberal consensus she decries, the kind of subtle bias that reflects her natural allegiances as a part of liberal media. I myself note the absence of any mention of cryptocurrency, of which she would have been familiar given her 2018 appearance on the Reply All podcast for an episode on lost Bitcoin. The curious omission of perhaps the most obvious of “the obvious frauds” of recent years invites conjecture (and let me be clear, it’s only conjecture) on possible involvement in the crypto space, especially given how a writer famous for her confessional style also omitted that her family operated a predatory recruitment agency in the Philippines whose exploitative practices smuggling teachers into the United States bordered on human trafficking by some accounts. But this sort of hypocrisy does and would only underscore her general point that, if everything and all of society is a scam, we are all by definition complicit. Might as well get yours!

The ways in which we are complicit in our own deception, sometimes through motivated self-delusion, is mostly absent from Nobody’s Fool. Somewhere in their habits and hooks, Simons and Chabris should have made more of the external forces that drive both our thinking and our behavior. They can come off as naïve or even obtuse on the matter. The book is full of references to people who “should have known better.” For example, they chastise experienced financial investors for being duped by Bernie Madoff. This ignores evidence suggesting many investors in Madoff Securities knew the operation was fraudulent and provided hundreds of millions of dollars in liquidity, as necessary, to keep the scheme afloat. Some of these purported “victims” profited more than Madoff. The problem wasn’t that they didn’t know better. They appear to have known exactly what was going on and wanted their cut.

Press them hard enough, and many crypto investors will admit crypto is a scam. I witnessed this a number of times while writing and reporting on the space. Maybe crypto is a scam, they concede, but everything is a scam. In the parlance of crypto world, the “stonk” market is also just a pyramid scheme funneling money returns from “noobs” to longtime “hodlers.” Setting aside that stock represents a legally enforceable claim of ownership over real companies whereas crypto is nothing more than digital credit on a distributed ledger, there is a kernel of truth to this nihilistic cynicism.

The Federal Reserve has been manipulating markets via quantitative easing and financial sector bailouts for years and is now attempting to engineer a recession to drive down employment and rising wages. Such interventions in the economy, carried out largely undemocratically, in a time of rising living costs, deepening economic inequality, and diminishing expectations for the average person certainly gives, at the very least, the appearance that financial markets and the whole economy are rigged.

In such an economic environment, crypto can seem like the ticket out. Where else can you 10X or 100X your money in the course of a few years? Sure, it’s a scam. Many investors will lose money, but some do score big. Simons and Chabris would warn such investors away from returns that seem too good to be true. For example, they cite unrealistic returns promised by BitConnect, one of the many crypto lenders exposed as a Ponzi scheme, as a hallmark of fraud. Such advice fundamentally misunderstands crypto world. Sketchy returns are not a flashing red light to stay away but rather a sign to get in quick while you still can. When the inevitable crash comes, the only thing separating scammer from victim is whether they bought or sold at the top. Every one of them wanted in on the grift. What these people need isn’t tips on avoiding scams but rather a lesson in moral virtue or, better yet, restrictions on and repercussions for taking part.

But Simons and Chabris explicity warn against such interventions. Too much emphasis on preventing fraud and deception, they claim, risks introducing inefficiencies that stymie “commerce, growth, and progress.” Such efforts might set off “an upward spiral of regulation.” In a segment on doping in sports, Simons and Chabris write: “But there have always been and probably will always be ways of avoiding any regulation. A constant cycle of new rules and new evasions is an inevitable consequence of the economic incentives for successful cheating. But the fact that scams are constantly evolving doesn’t mean you have to be a victim.”

In other words, fend for yourself.

Nobody’s Fool, which is essentially yet another entry in the bourgeoning self-help genre, exemplifies what psychologist Ole Jacob Madsen calls “the therapeutic turn,” or the intrusion of popular psychology into more and more areas of public life. It is no coincidence that the therapeutic turn coincides with the neoliberal turn. Psychology, as Madsen argues in The Therapeutic Turn: How psychology altered Western culture, tends to offer only individualistic solutions to societal problems. (Similar and related arguments have been put forward by Barbara Ehrenreich, Christopher Lasch, and a number of other theorists, but the critique is particularly searing coming from one of the profession’s own.) This is certainly the case with Nobody’s Fool, which is almost entirely devoid of structural or contextual analysis, as works of this type are wont to be. Madsen warns: “If psychology loses sight of the structural level beyond the individual psyche and simply fails to recognise how its own practice is influenced by and influences current societal processes, it is at risk of becoming a social institution with a clear ideological bias that conceals the ailment’s cause, prevents social changes and, in the worst case, produces more suffering and indirectly increases the incidence of psychological ailments in the population.”

If behavioral psychology offers the appearance of scientific legitimacy to neoliberal governance, the reproducibility crisis in the social sciences, and especially psychology, in which several studies revealed that more than half of published findings could not be replicated, should invite skepticism. To their credit, Simons and Chabris cite several cases of academic fraud in academia and scientific research, including those in their field, and even make passing mention of “the perverse incentives that lead to shoddy science.” They specifically take issue with the concept of “priming,” which is the process by which exposure to stimulus supposedly influences subsequent responses to future stimulus. Prominent figures in the field promoted and popularized studies concluding that even subtle stimulus can have an outsized effect on future behavior, though these conclusions were later shown to be flawed and unfounded. However, Simons and Chabris suggest that such problems have been addressed over the past decade and that the “excess of misleading, unsupported, and sometimes fraudulent claims” made within the field are mostly a thing of the past.

Others disagree. In his 2021 book, The Quick Fix: Why Fad Psychology Can’t Cure Our Social Ills, journalist Jesse Singal dissects pseudoscience surrounding widely popularized psychology concepts, not just priming, but also “grit,” implicit bias, and the supposed power of positive thinking. The book provides a more detailed—and damning—account of the ways in which social science researchers trying to further their careers engage in p-value hacking and other data manipulation in order to find statistically significant relationships where none exist. Moreover, whereas Simons and Chabris offer only a better understanding of “habits and hooks” for helping individuals identify such deception, Singal joins other critics in arguing that addressing pervasive social ills requires action of both individuals and, especially, institutions.

Critiquing a book for not being that which it never set out to be is arguably unfair. Simons and Chabris explicitly state that they do not offer a “sociology of deceit.” They are not sociologists, journalists, or social critics. They are, again, psychologists. Unfortunately, there is only so much narrowly focused behavioral psychology can tell us about the world, even a world so intently and increasingly focused on the self, the individual—a world the discipline played a heavy hand in forging and legitimizing.