Politics

The Problem with the Diversity Dividend

The last decade has seen Corporate Social Responsibility metastasize into what has become known, derisively, as “woke capitalism”—a new vision of companies as agents of radical social change. The outward face of this shift has been a torrent of adverts and products laced with political messages. Ben and Jerry’s, for example, marketed anti-Trump ice-cream, and Marks and Spencer added guacamole to their BLT sandwiches to mark LGBT Pride in 2019.

Today we launch Pecan Resist! This flavor supports groups creating a more just and equitable nation for us all, and who are fighting President Trump’s regressive agenda. Learn more and take action here >> https://t.co/Bi8YE1FvOZ pic.twitter.com/Kr6CKBX1sc

— Ben & Jerry's (@benandjerrys) October 30, 2018

A number of commentators on the Left, such as Owen Jones, Arwa Mahdawi, and Helen Lewis, have dismissed such gestures as superficial “woke-washing.” Nevertheless, the business community’s most senior leaders now endorse a vision of stakeholder capitalism in which a company’s directors should promote their own nebulous conception of the public good before they consider the interests of shareholders.

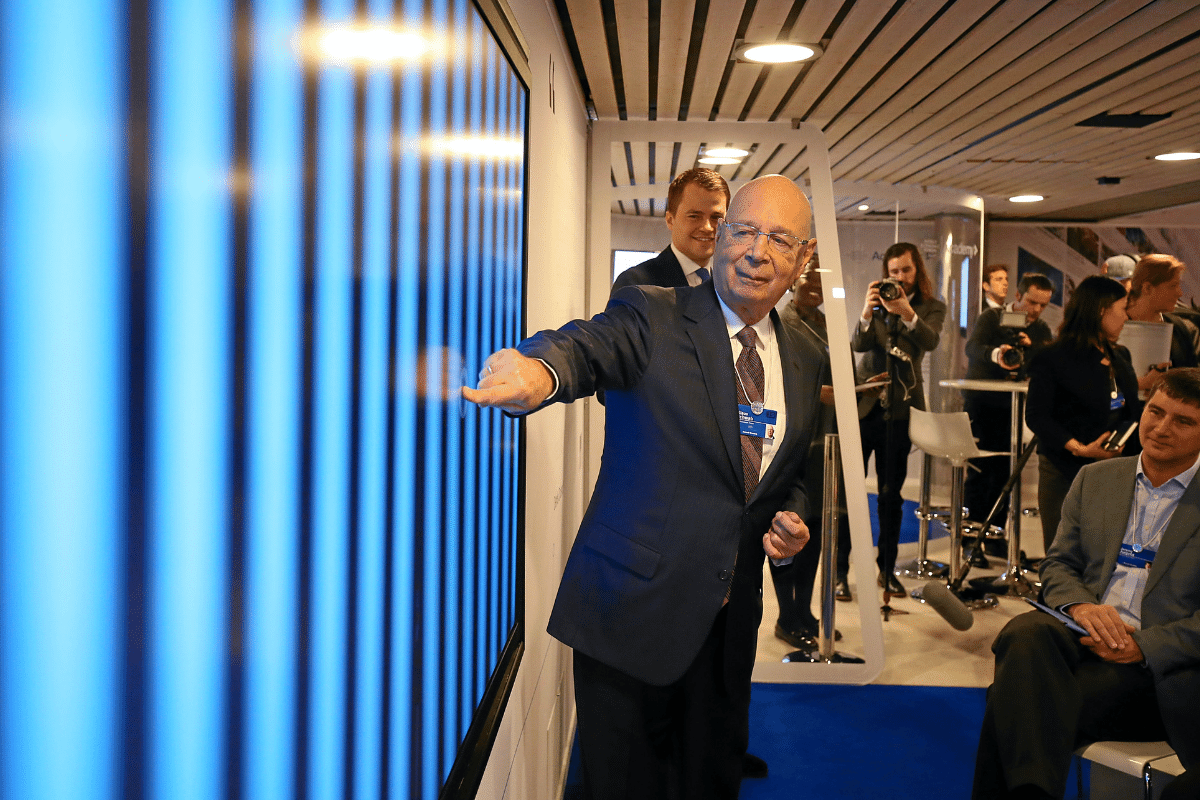

Figures like the World Economic Forum chairman Klaus Schwab, BlackRock’s Larry Fink, or Marty Lipton, founding partner of Wall Street’s most profitable law firm, have assumed the mantle of crypto-politician, absent the accountability of a real public servant. Asset managers like Fink, who is entrusted with $10 trillion of holdings, are willing to use their influence across the market to force smaller companies to conform with their vision of social justice by refusing to invest in them or provide financial services.

Investment banks are getting in on the act too, with Goldman Sachs announcing last year that it would not take companies public unless they hit board diversity targets. Like all prevailing corporate trends, this militant progressivism has garnered an authenticating acronym: ESG (Environmental, Social, and Governance considerations). A cursory Google search will confirm its ubiquity.

In the last five years, there has been a striking change in the perception of ESG from a burden to a benefit. No longer the valiant sacrifice required of a CEO, activism and social engineering are now represented as the means to acquire a competitive edge. Central to this change is the concept of the “diversity dividend”—the supposed financial benefit derived from a workforce that represents different racial, sexual, and gender minorities in predetermined ratios.

Though this idea has proliferated widely, there have been relatively few attempts to substantiate it. The citations that populate articles celebrating the dividend and its alleged benefits all return to a series of reports conducted by consultancy firms using opaque proprietary data (McKinsey 2015, 2018, 2021, and BCG 2018). But rather than challenging the dividend hypothesis itself, I want to look at other reasons DEI prescriptions may benefit certain sorts of company—the same kinds of company which can afford to contract with McKinsey.

The diversity dividend inadvertently demonstrates the presence of a new form of regulatory capture which I call “ESG capture.” By this, I mean the creation of capital burdens and other barriers to entry which undermine smaller players in the market and embed the advantages of incumbents. This phenomenon goes some way towards explaining why woke capitalism has become a “top down” trend, projecting outwards from the largest and most powerful corporations on the planet. One of the great dangers of ESG capture, then, is that it assists the formation of oligopolies.

First described by the economist George Stigler in the 1970s, the phenomenon of regulatory capture is now well-established. It refers to the process whereby government agencies come to be dominated by the very interests they seek to control. Although consumers are the intended beneficiaries of most regulation, they are insufficiently resourced, organised, and informed to lobby for their own interests. On the other hand, companies possess both the means and the incentive to do so.

Regulatory capture has taken many forms. Some industries have lobbied aggressively for limited regulation (think big tobacco in the 20th century), while others have demanded more regulation to disadvantage future competitors (think rail companies in the 19th century). The second approach to capture is often more effective because it plays on the public perception that big business opposes regulation, and that regulation reduces profit margins. But while that assumption may be true for some actors in the market, the largest companies can accommodate the short-term impact on profitability to realise long-term strategic advantages.

Those big enough to absorb the punishment can bide their time until poorly capitalised competitors are wound up, and then recoup their losses by exploiting the increased market share they inherit. By calling for ESG regulations, powerful businesses force the widespread adoption of financial burdens. Though the burdens may be equally distributed, the ability to bear them is not. In the short term, large businesses with deep pockets and a significant market share can accept the adverse consequences of ESG policies, while small- to medium-size businesses sink.

ESG capture is having its greatest impact, first, on affirmative action in employment, and second, on the escalating costs of Human Resources and legal compliance. ESG capture is different from traditional regulatory capture because it is as much a media phenomenon as it is a legal one. The attempt to create an ESG culture is intended to capture the public at large as well as the relevant regulators. Large companies stir up media pressure with publicity stunts like massive donations to fashionable causes, voluntarily relinquishing revenue in the name of social justice. This creates an expectation that other more unstable companies will follow suit for fear of being branded bigots and losing custom if they fail to do so.

The use of intersectional hiring and promotion strategies rather than conventional performance indicators is a central tenet of ESG ideology. No doubt, there are advantages to the employment of a diverse workforce, but the most important kinds of diversity are diversity of knowledge and expertise. Familiarity with the customs or language of another country can be relevant to an employer who engages in a good deal of international business. Yet this kind of knowledge is not necessarily related to a person’s skin colour, sex, or sexual orientation. Hiring people for any reason other than their ability to do the job at hand is going to have negative effects on an organisation’s productivity.

That said, the extent of economic harm inflicted will depend upon the nature of the employer’s applicant pool. Given that they are attractive places to work, market leading companies can pick and choose between highly qualified candidates rather than scrounging for an applicant who has the minimum competencies. For large companies, missing out on the most talented applicant would mean losing a supererogatory benefit—not ideal but hardly disastrous. Such a loss could prevent smaller companies, however, from accomplishing an essential business function.

Furthermore, companies who dominate their respective market enjoy sizeable profit margins which insulate them from the impact of affirmative action policies long enough to outcompete others. The legal situation in the UK is less extreme than elsewhere because it only allows for “positive action” in recruitment rather than determining quotas before advertising a position (as has happened at various points in the US and South Africa). But that may provide scant consolation if this phenomenon is driven by the Internet and the media as much as it is driven by the law.

This problem is exacerbated by regulators requiring disclosure of ESG metrics which can then be used to punish employers who prefer equality of opportunity to equality of outcome. The UK’s Financial Conduct Authority and the US Securities and Exchange Commission already have rules requiring companies to promote diversity in corporate boards. On top of this, the FCA’s latest proposal would require public companies to “disclose annually on a comply or explain basis whether they meet specific board diversity targets and to publish diversity data on their boards and executive management” as a condition of listing shares. The SEC is currently contemplating similar measures.

The ESG drive is also creating spiralling HR and compliance costs. In some sectors, compliance burdens are so high they resemble taxes. The Risk Management Association found that half of banks surveyed spent more than six percent of their revenue on compliance, which translates to an average cost per employee of around $10,000. It is difficult to disentangle the expense of ESG compliance from other regulatory burdens, but the costs are surely mounting as the risk of ruining a perfect ESG score with an employment dispute increases. The global HR market has been increasing steadily year-on-year, from around $343 billion in 2012 to $476 billion in 2019. Only the pandemic has seen it decline for the first time in decades.

As ESG pressure produces more complicated regulations around employment diversity and mental health, the cost of HR is likely to rise, and economies of scale will determine who can accept these costs. On top of traditional HR managers, there are now numerous full-time diversity administrators who can charge eye-watering sums. The average pay for a US Diversity and Inclusion manager is $83,889. The combined sums spent on diversocrats are typically in the millions. This problem has already been identified at a number of elite universities where the data is a matter of public record; the University of Michigan spends $11 million a year on diversity administrators and paid one senior figure alone over $400,000.

Heather Mac Donald has written at length about the bloated “diversity industry”—globally, the number of roles has increased 71 percent over the last five years. And this is before we count the cost of diversity training. According to Harvard Professor Iris Bohnet, the US now spends $8 billion a year on Equality, Diversity, and Inclusion training. According to her agents, White Fragility author Robin DiAngelo currently charges companies $30,000–40,000 to lecture them about systemic racism for an afternoon. That might sound steep, but it’s a bargain next to other diversity speakers. An appearance by Cornell West, Kimberlé Crenshaw, or Brittany Packnett Cunningham might set you back as much as $100,000.

Recent work by Vincent Harinam casts doubt on the view that woke capitalism is consumer-driven, showing that progressive advertising does not translate into sales revenue. Instead, it works from the top down and can have destructive monopolistic implications. McKinsey may well have been right to declare that “diversity is a competitive differentiator shifting market share toward more diverse companies,” although not for the reasons they adduce. As their report concedes, “the relationship between diversity and performance highlighted in the research is a correlation, not a causal link.” But, in the general run of things, companies with the disposable income necessary to achieve the best ESG scores are already in a position of market dominance and ESG initiatives simply allow them to further entrench their advantages.

ESG capture may not be a cynical strategy on the part of directors. It is possible that CEOs have been enculturated and now genuinely believe in the synergies of intersectional identity groups. Blinded by faith in progressive causes, they interpret the anti-competitive advantages that flow from ESG capture as a diversity dividend—a healthy return on their investment in Social Justice Plc. It is no doubt reassuring to see the failure of one’s competitors as a reflection of their retrograde self-interest and prejudice.

But ESG capture is actually just accelerating the shift from a liberal market economy to a species of crony capitalism in which oligopolies prevail. The gap between small and large companies has been expanding for decades and has reached new extremes during the pandemic. Like many dangerous ideas, the diversity dividend is seductive. It marries the profit motive with a desire for ethical achievement, creating a righteous fervour among its adherents. The complex equilibria that comprise capitalist society have enacted sweeping changes to the way we think and interact over the past 200 years. To dismiss their corruption as mere “woke-washing” is wrongheaded and dangerous.