Science / Tech

The Case for Electric Vehicles

Electric vehicles are currently being designed to drive for longer and in a more efficient manner than traditional, fossil fuel-burning vehicles.

Elon Musk is trying to lead the world to a better place with his commitment to electric vehicles. Specifically, he is leading American middle-class families of the future towards cheaper, more efficient cars and energy usage. Musk’s desire to make America competitive in the budding electric car market is not only good for American consumers, but it is also good for the United States: it will help make the country more energy independent, thereby liberating America from having to depend on dubious oil-producing states. Musk should not only be commended for his pioneering work, but the United States government should continue subsidizing his work to remain competitive in the 21st century economy.

Since its inception in 2006, Tesla Motors has contributed significantly to research into and development of the electric car in the United States. The electric car is not a new idea. Yet, it never fully captured the imagination of Americans the way the traditional fossil fuel-powered vehicle did. However, the Great Recession of 2008 (and the anemic recovery that followed), placed many Americans in a position where even the cost of fuel for their vehicles was becoming an onerous expense. Despite the positive changes occurring in America’s economy today, Americans are still strapped for cash and in need of cost-saving measures wherever they can find them.

Some critics are quick to point to the current expense of electric vehicles compared to the lower costs of fossil fuel-powered vehicles as a reason to discontinue subsidizing Tesla. While electric vehicles are more expensive than ordinary cars today, their prices have plummeted 80 percent in six years. In due course, the price of electric cars will come to match those of similar non-electric vehicles.

Ultimately, it is the hope of Elon Musk (and myself) that electric vehicles will prove to be a more economical option for a majority of Americans than traditional fossil fueled-powered vehicles. You see, electric vehicles could not only keep long-term energy costs for Americans relatively low, but fully developing the technology now would help the United States prepare for the day when we’ve reached the peak production of most fossil fuels.

Hitting Peak Fossil Fuels

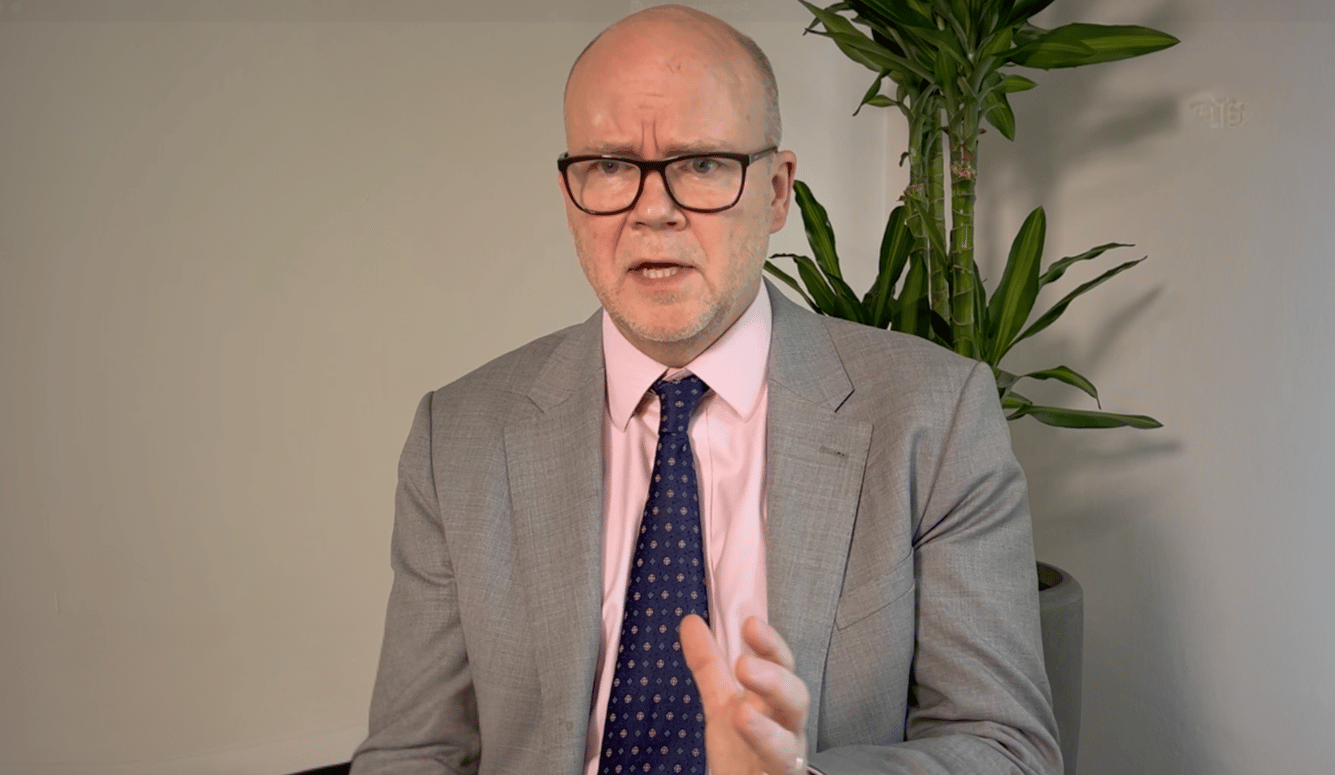

British Petroleum’s chief economist, Spencer Dale, predicts that, “cars will be used more in the future, traveling longer distances.” So, rather than Americans moving closer to the cities (where the majority of jobs are), and relying less on cars, it is likely that Americans will continue moving farther away from work (due to the high cost of living in and around the cities), looking for more economical—and faster—ways of transportation. Electric vehicles are currently being designed to drive for longer and in a more efficient manner than traditional, fossil fuel-burning vehicles.

It is also believed that by 2030, nearly one-third of all vehicles (around 320 million worldwide) on America’s roadways will be electric. Most assume that this number will increase over time, particularly as fossil fuels become more expensive. The reason that fossil fuels would become more expensive is because we will have reached a peak in their production. Reaching a peak in production is when one reaches the maximum output possible of a given commodity, based on the available resources. Once those resources peak, everything that comes after will be in decreasing amounts. This, coupled with potential high demand, would cause prices to skyrocket.

Interestingly, BP predicts that the world will reach peak oil around 2030. Other major oil producers, such as Royal Dutch Shell see peak oil arriving by 2025. Meanwhile, the American oil producers, represented by ExxonMobil and Chevron, believe that no peak will come at all. According to energy analyst, Nick Cunningham, these views highlight “a bit of difference” between European and American producers.

Even so, the mere fact that American producers are beginning to rely more heavily on the fossil fuels produced through shale gas and other unorthodox drilling techniques indicates that, quite possibly, more easily accessible quantities of fossil fuels are declining. American oil producers believe that North America’s mostly untapped oil and natural gas stores will effectively ensure that the United States is the world’s leading fossil fuel energy producer. But, both ExxonMobil and Chevron’s postulations are predicated on forecasting models that might be flawed.

Justin Montgomery and Francis O’Sullivan of MIT’s Energy Initiative believe that forecasting models used by the United States Energy Information Agency “have a tendency to significantly overestimate the impact of technology because they are not flexible enough to account for these short-distance locational variations present in the data.” Montgomery and O’Sullivan assessed that, “current forecasts for future production and cost of tight oil and shale gas resources in the United States may be overoptimistic [sic] due to unrealistic expectations of future technology-driven productivity gains—an important consideration for any transition to a lower-carbon future where natural gas plays a bridging role in the power sector.”

We already know that several of the world’s leading oil and natural gas fields have been depleted. While energy companies are presently locating new sources, they are located in harsher, harder-to-reach (and therefore more expensive) locations—notably in the Arctic (which is why Russia has made the Arctic such a primary point of its foreign policy). This fact is also why the American energy producers, such as ExxonMobil, are so keen to tout the benefits of shale production. And, to be sure, we need every bit of cheap energy we can get. But, the real issue is one of sustainability.

Are these new sources of fossil fuel energy reliable over periods longer than two or three decades? The answer is likely “no.”

Also, Goldman Sachs reported in 2015 that the world had reached peak coal production in that year. All you need do is look at how erstwhile users of coal energy, such as China, are diversifying their energy portfolio away from coal toward something more reliable. This isn’t just good business; it’s also a response to declining coal production.

Curbing Demand

Plus, don’t forget that there is not a set date for peak oil. While it’s likely to happen at some point in time, it can be pushed back. It’s all about demand. Thus far, we have prevented peak oil by finding new and innovative drilling techniques. But, that alone will not push the date of peak oil back too far. Reducing the demand for oil—which will dramatically increase, thanks to the economic development of countries like India and China—over the next two decades will be key. Having a third (preferably more) of all vehicles being electric will help to reduce the onerous demand for fossil fuels.

The electric vehicle can be a wonderful stopgap—or a refuge—for a world that is in dire need of diversification of its energy production. No one is saying that oil or natural gas or coal will simply vanish. What Musk and others are arguing for is a viable, renewable alternative to avoid excessive reliance on a product that is inherently finite. Having an energy portfolio that includes a large—and growing—number of electric vehicles will achieve these goals. Rather than waiting for a fossil fuel crunch in the 2030s, why not simply continue (and expand on) the investments that Musk and other visionaries have made in the electric vehicle industry?

As a taxpayer, that is a worthwhile use of my money (far more so than bombing another Middle Eastern country).

It’s Less About the Car and More About the R&D

Musk’s detractors point out the flaws in Tesla vehicles; they complain about Tesla’s failures to deliver on Musk’s grandiose claims (which he does eventually deliver on, mind you); and they believe that the Tesla cars are poorly built. Whatever may be the case, the benefit of Tesla Motors is in the R&D into a vehicle that, as I’ve argued above, will be essential for the future prosperity of the United States.

If left to its own devices, the private sector in the United States would never have funded electric vehicles. Elon Musk and Tesla got the proverbial ball rolling thanks, in large part, to subsidies from the United States government. Some may find that to be “crony capitalism.” But, since government R&D spending has been on the decline for 20 years (and since the U.S. needs technology of the kind that Musk is developing), subsidies are a small price to pay.

The Chinese have a saying, “The time to repair the roof is when the sun is shining.” Thus, the time to invest in electric vehicles is not when we’ve actually hit peak oil, but rather in anticipation of hitting peak oil. Whether the Tesla vehicles are built as well as cars comparable to the Tesla prices is irrelevant. The more important issue is whether the research and development of the actual technology that will make EVs work properly (and cheaply) is being done. That way, when the time does come, we will not suffer significant disruptions (and we might even delay that date). Face it: the electric vehicle is not going away. Better to dominate this budding industry rather than cede it to a fierce competitor, like China.