· 22 min read

Keep reading

Disco Inferno

George Case

· 10 min read

Conflicting Visions of Peace

Benny Morris

· 8 min read

When Women Are Radicalised

Claire Lehmann

· 8 min read

The First Journalists

Iona Italia, Quillette

· 60 min read

Buckley’s Blind Spots

Ronald Radosh

· 25 min read

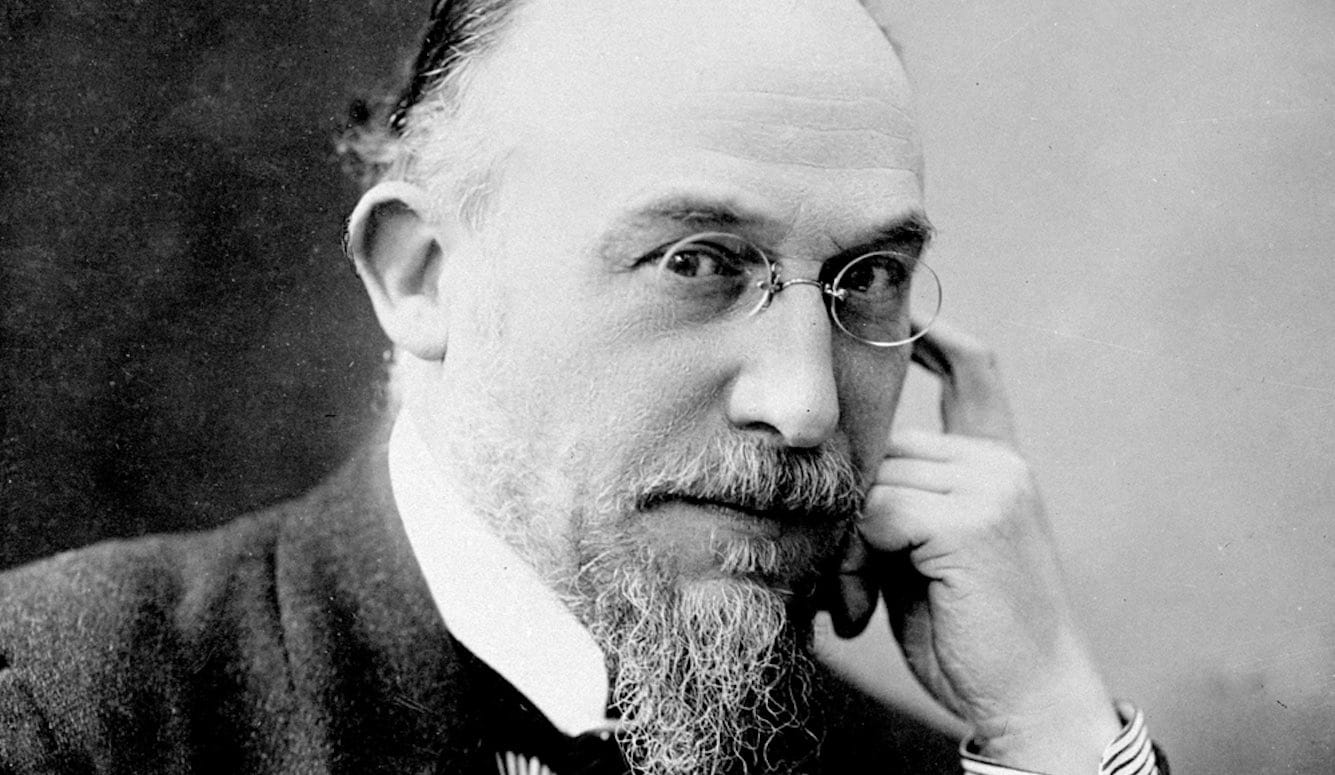

The Art of Not Quite Listening

Thomas Larson

· 9 min read