The Rise of Hot Capital

Hot Capital is money that moves quickly and mimetically, following the latest fad or culture war skirmish. And right now, huge sums of money are being mobilized and channeled into projects, companies, and causes as a result of inflamed, rivalrous passions. The rise of this “Hot Capital”—made possible by money that is practically free—has led to the decadent funding of small-minded and small-spirited coups under the guise of grandiosity, and it is mortgaging our future. Escaping the destruction cycle will require more than smart monetary policy and a return to reality in markets. It will require the adoption of long-term goals that transcend the logic of war.

Donald Trump’s SPAC, the Trump Media and Technology Group, with its soon-to-be-released app called “Truth Social,” has already attracted enough capital to value it at well over $1 billion—with little to show for itself other than heated rhetoric and a user interface that looks identical to Twitter.

In 2021, Tariq Fancy, the former CIO of sustainable investing at BlackRock said that investments based primarily on ESG concerns are “a dangerous placebo that harms the public interest.” Meanwhile, morally-panicked investors have funneled more than $1 trillion dollars into products like Green Bonds—debt issued by companies to finance environmentally-friendly causes—which have questionable impact, but which also result in higher fees to money management firms like BlackRock.

Meme stocks, which made their spectacular entrance onto the global scene with GameStop’s parabolic rise in early 2021, have often been fueled by angry capital—as justified or righteous as that anger might be. In the case of Gamestop (or “Gamestonk”, if you prefer), a large amount of money was channeled as a vendetta against perceived injustices of the past. Company fundamentals didn’t matter. Retail investors who felt burned by the Wall Street crash in 2008 got in on the action. (My own temperature rose just watching the battle play out, and I was infected with an intense desire to participate—it took everything I had to stay on the sidelines.)

Hot Capital is not just “smart” or “dumb” money. It’s emotional money. This is why every good donor-driven marketing video in the world attempts to pull at people’s heart strings. But now the same kind of energy and anger that fuels most modern political campaigns is spreading to every other domain. And it’s affecting the way that capital is raised and how it changes hands.

A hot-enough take can attract large amounts of capital practically overnight. We’re living in the Hot Takeconomy, and Hot Capital is its currency.

Robin DiAngelo, who published her book White Fragility in June 2018, saw it practically become required reading during the George Floyd protests in the summer of 2020. She instantly attracted hundreds of thousands of dollars in Hot Capital from companies that wanted to hear her speak. It was the fear-driven form of Hot Capital. Had DiAngelo wanted to start a company (any company!) with a mission to combat racism, I imagine the venture capital arm of Tiger Global would’ve been knocking at her door with a Hot Capital check within hours.

Something has changed. A dark force is at work in the world. It’s the same force that has always allowed savvy politicians to quickly raise more money than ever before.

Now it’s leading to the creation of new (“free speech,” anti-woke) social media platforms and ritual social justice fundraisers. It now takes mere minutes for somebody to erect a GoFundMe page after something incendiary hits the news cycle. Start-ups actively tailor their fundraising pitches to battle-ready investors. Maybe you were lucky enough not to witness the web3 meme-war that went down on Twitter, and which showed just how thin-skinned the holders and deployers of this capital currently are.

Hot Capital is the financialization of the fight-or-flight response. It’s reactionary. Those who complain the most about Woke Capital, for example, are just as likely to use their crusade against Woke Capital to raise Hot Capital of their own—to draw attention to, say, anti-anti-racism work, or form the core of a political platform, or start the University of Austin).

Hot Capital flows to the loudest voices at a given moment. This capital is not priced to reflect the value that those voices and their companies and projects can create; its price is a reflection of the giver’s desire to win a mimetic game—and that is always an inefficient way to allocate capital. It hinders economic growth as it fuels ideological warfare and distracts us from building lasting works or addressing genuine structural problems.

We’d all be better off if this capital were channeled toward things that actually matter—things which contribute to the building up of a sustainable, integral human ecology. But that depends on breaking the mimetic cycle fueled by Hot Capital.

That won’t be easy. The quickest way to accumulate a lot of donations in today’s nonprofit sector, for example, is to create a threat and then ratchet up the fear mongering about this threat in order to raise a war chest. BLM does this to great effect on the Left. Christopher Rufo has employed similar tactics on the Right to spearhead a campaign against teaching Critical Race Theory in public schools, memeing his way into relevance and capital-raising. Everyone is playing the same game.

This would come as old news to René Girard, a French-born professor of literature and history who began articulating his insights about desire and conflict in the late 1950s. Girard recognized that people want what others want—mimetic desire—and come into conflict with each other not because they or their desires are different but because they’re fundamentally the same: in the case of the political Left and Right, that seems to be power. Or as Jonathan Haidt and Greg Lukianoff have put it: “the right's monomania and the left's Great Awokening feed each other.”

According to Girard, mimetic desire breeds rivalries, which in turn breeds never-ending conflict—an unfortunate state of affairs that I caution against in my book Wanting: The Power of Mimetic Desire in Everyday Life. Girard believed that there was a way out of this spiral of conflict, though. It starts with a clear-eyed recognition, and then a renunciation: seeing that what we’ve been fighting over is self-destructive, and that we have more to gain by renouncing our fixation with our rival than by embarking on the infinite game of trying to defeat him.

Hot Capital exacerbates the very problem Girard identified. It achieves exit velocity by superheating mimetic rivalries—often intentionally. The power players marshaling this capital aren’t using it to construct Mont Saint Michel Abbeys or Chartres Cathedrals. Instead, they’re gathering it to differentiate themselves in the marketplace of ideas and using it to build more weapons for a final showdown. Give this money to us, goes their Hot Capital sales pitch, and we’ll put a stop to them because we want the opposite of what they want. (Don’t you?)

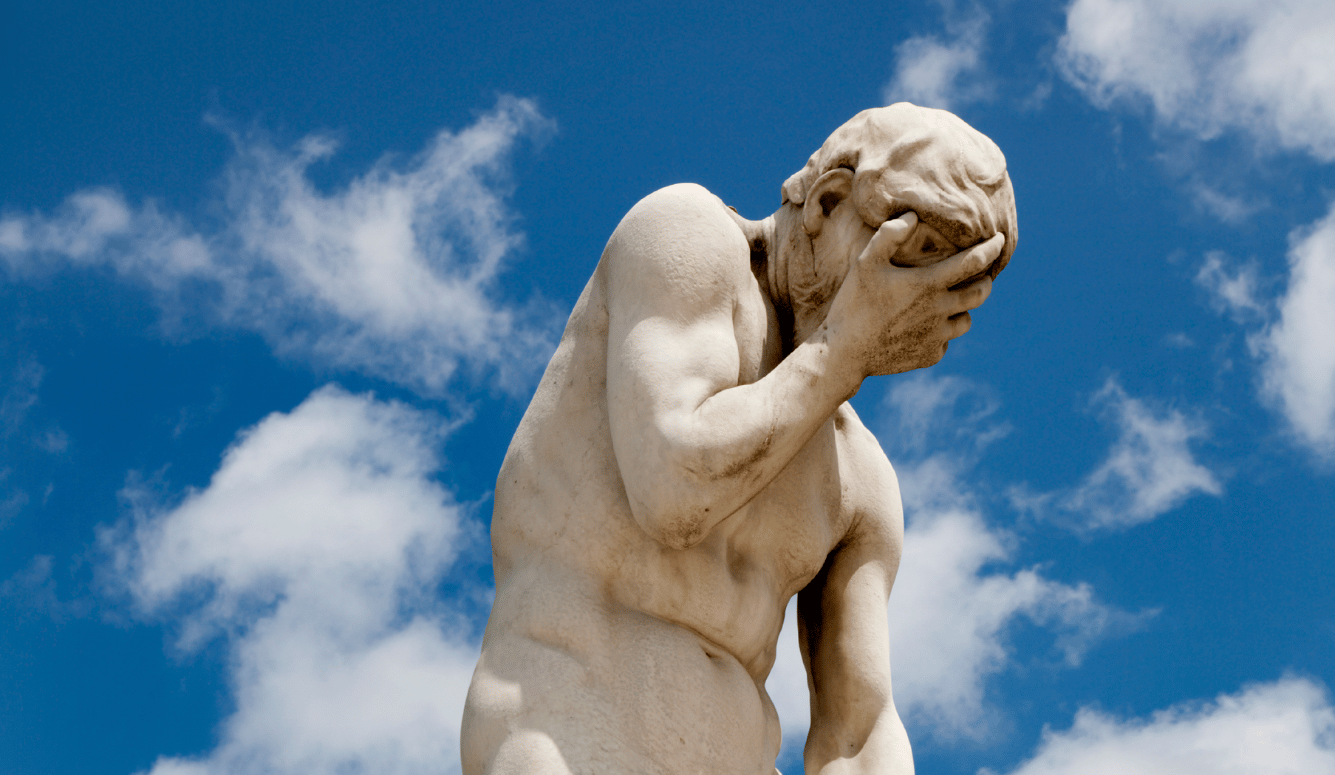

In a mimetic rivalry, objects take on value because the rival wants them. They want CRT in the schools? So be it; we’ll stop CRT by force of political will if we have to, and we need the donations of allies and comrades like you to do it. Every victory is ultimately Pyrrhic, though. By defeating your enemy, you paradoxically defeat your own reason for being. And that’s why the cavalier deployment of Hot Capital is not just wasteful. It’s idiotic.

René Girard understood this tendency, too. “Modern individualism assumes the form of a desperate denial of the fact that, through mimetic desire, each of us seeks to impose his will upon his fellow man, whom he professes to love but more often despises,” he said. As I read this quote now, I understand “impose his will” as having turned into “impose his will by pouring capital into initiatives that lead to ever-greater amounts of censorship and unfreedom for our enemy.”

How high will temperatures rise? It’s hard to say. Right now, Hot Capital is polarizing the world. Each side is rushing to build its own communications networks, infrastructure, even universities. The economy is fragmenting into red and blue companies and corresponding capital streams—but the common denominator is that they’re Hot.

“Mainstreaming your differentiators” is a buzzy catchphrase in the marketing trade, and Hot Capital achieves market segmentation and demographic hyper-targeting as easily as a bug lamp attracts flies. Even peripheral players in the Hot Capital game, such as the red-coded Black Rifle Coffee Company and the blue-coded Impossible Foods, help drive always-already polarized consumers into the appropriate camps. A libertarian-leaning supplement company founder—now a convicted felon—recently juiced sales of camouflage-branded sports supplements merely by pulling his company’s sponsorship from Arnold Schwarzenegger’s fitness events due to the “Governator’s” stance on vaccine and mask mandates. In this sense, Hot Capital is sales and marketing on “God Mode,” with every cheat code enabled.

But the mimetic rivalries ginned up by Hot Capital are also incredibly toxic–and many times more viral than even the most contagious instance of a coronavirus. In Wanting, I write about the importance of shielding ourselves from this infection and learning to desire a future that isn’t mediated to us by our rivals: one outside of the cycle. Given the stakes of the social conflict that Hot Capital fuels, this is critically important. We would be wise to renounce our roles in these rivalries. Mimetic rivalries are always, ultimately, destructive, and make fools of even their most ardent and heroic crusaders.

Cooler heads will discover the rational alternative to Hot Capital. In the process of heating up these rivalrous mimetic desires, Hot Capital doesn’t temper them like steel–it makes them thin and frangible, revealing precisely how superficial they are. They have no staying power.

If we recognize this, the rise of Hot Capital can serve not as the cause of our undoing but rather as an event that reveals the place where we need to dig to find something truly valuable. For example: the fight over CRT in schools is one place Hot Capital is flowing to right now—but what might that lead us to see about the deeper, structural issues with education? About the role of parents and the family? About the way we talk about racism? When Hot Capital fixates attention on a single Archimedean point (however illusory it may be), valuable opportunities are lost elsewhere.

So as Hot Capital is funneled to the Hot Heads with the Hottest Takes, let’s consider the value of Cold, Measured Capital deployed by those who stand at least somewhat outside of the mimetic crisis—those with the ability to look with sober eyes at the things that will contribute the most to the common good over the next 10 or 20 or 50 years. These are the “thick desires” that will endure long past the time when Hot Capital has cooled and its idols have been forgotten.

These thick desires are less contagious, less accessible, and at times obscured by noise—but they are nevertheless protected from the volatility of changing circumstances in our lives and in the political climate. They are worth investing in.

One need not be an investor to begin doing this. It starts by developing an anti-mimetic disposition—a “critical distance”—from the mimetic flow of capital. This creates investment opportunities of time, attention, and long-term commitment.

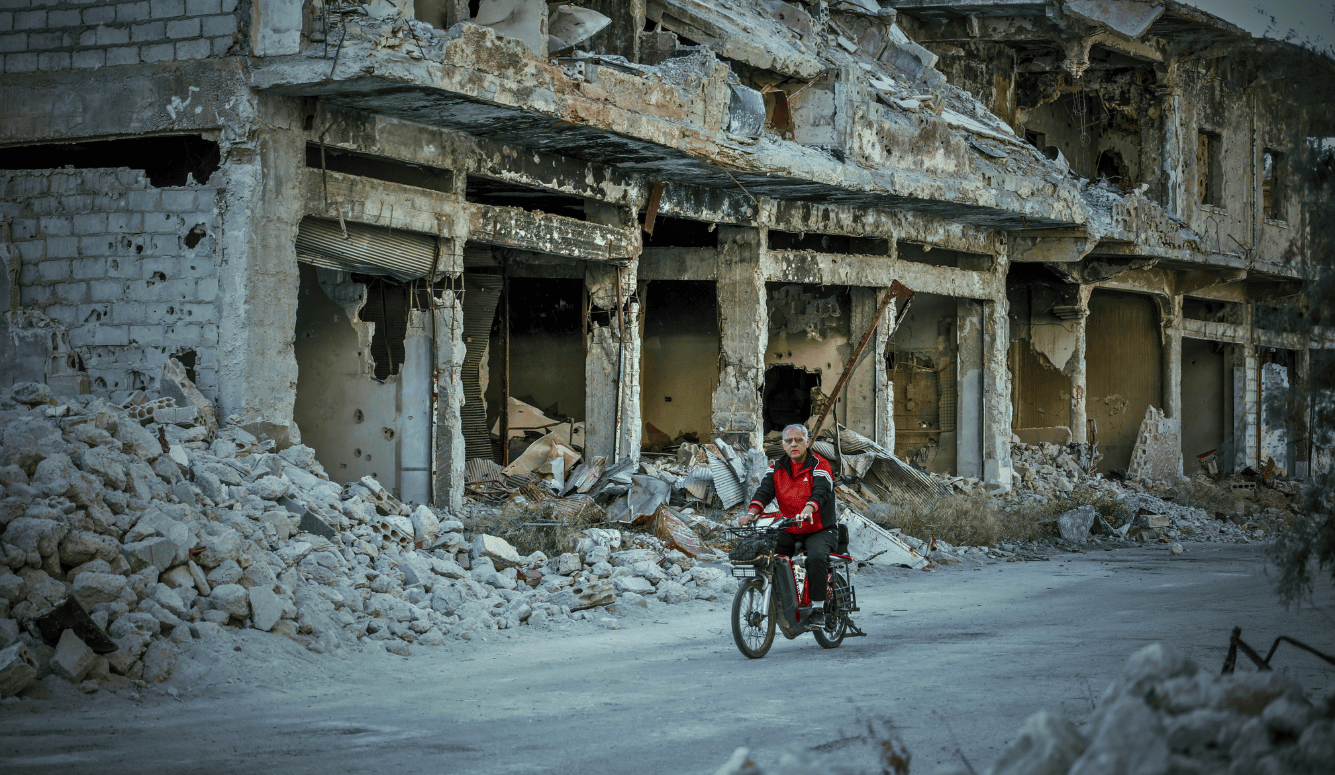

Hot Capital merely scorches the earth, turning the world into an impoverished desert for civil discourse and human flourishing and calling it “good, actually.” Winning these tiny mimetic games is precisely how we all lose—because when you play stupid games, you win stupid prizes.

There are important investments that each one of us can make today, and it doesn’t depend on what the Hot Capitalists are doing. Let them burn.