Entertainment

Gambling in a Time of Despair

If lawmakers want to help their constituents fight compulsive gambling, then putting the brakes on legalization is the most impactful policy in the short term.

Last year in June, the New York State Senate voted to legalize mobile sports betting. For a moment, it seemed like New York was poised to join its neighbor. New Jersey had sued and successfully convinced the Supreme Court to overturn a federal ban on sports gambling outside Nevada the previous year. The state legalized mobile betting apps shortly afterwards. Now, it was collecting the gambling fees of frustrated commuters from across the Hudson River while New York’s government lost millions of dollars in potential revenue.

It was New York’s chance to catch up with the Joneses. “I got racinos who could use the help. I have racetracks who are suffering. This helps everyone and it stops people from going to Jersey,” Senator Joseph Addabbo Jr. asserted. As the author of the bill, he claimed that legalization also had “tremendous potential to create jobs and raise significant funding for education and other vital public programs.” Not everyone was so buoyant about the proposal. “I am not a fan, pardon the pun, of the new mobile sports betting,” Governor Andrew Cuomo stated during a radio interview. “You can bet any time from your cell phone.” Governor Cuomo argued that legalization would violate the state’s constitution, which only permits sports betting in casinos. His opposition and the end of the legislative session ensured the bill’s demise before it could reach the State Assembly, even though it had enjoyed overwhelming support from both Democrats and Republicans in the Senate.

Meanwhile, Senator Addabbo has remained sanguine about legalization’s long-term prospects. “It’s not a question of if; it’s when,” he told journalists recently. But with budgetary and legislative paths no longer an option, the next step would be a referendum to amend the constitution—a process that could take up to three years. Faced with such long odds, Senator Addabbo was understandably frustrated, and left the world a colorful tweet shortly before the state legislature adjourned:

While the effort to legalize mobile sports betting in New York has come to a standstill, the contours of the political debate are immediately recognizable: tax revenue, jobs, ending the black market, and inevitability. It’s hardly an outlier in a country where all but two state governments now support gambling to patch up budgetary shortfalls. Unfortunately, the revenue from traditional games of chance has started to ebb, and American policymakers are legalizing novel, potentially dangerous forms of gambling at a time where the normal protective factors against developing an addiction have eroded.

For decades, lawmakers have viewed gambling as an answer to their budgetary dilemmas. Politicians can lose their jobs if they raise taxes or cut public services, even though at least one of the two is necessary for funding the government. Many lawmakers are obviously concerned that such actions could also harm their constituents. On the other hand, the revenue that the government collects from gambling is voluntary. (Compulsive gamblers may feel differently about that last point.) Furthermore, gambling is a socially acceptable form of entertainment. Most Americans have gambled at least once in their lives, and the majority of those who gamble do not develop an addiction.

State governments collect most of their gambling revenue from either lotteries, casinos, or racinos, which are a hybrid of racetracks and casinos. Casinos and racinos are privately owned but heavily taxed and regulated, whereas lotteries are usually administered by the state government or a nonprofit. Forty-one states use a lottery to fund their educational and welfare programs. Lotteries are especially popular, not least because states market them aggressively. In the fiscal year 2017, New York alone spent $81 million dollars advertising its lottery, and it was rewarded with $9 billion dollars for its education department. Senator Addabbo’s protests notwithstanding, the Rockefeller Institute reported that New York managed to fund around eleven percent of its governmental operations with revenue from gambling in 2016—the most of any state.

Why is the lottery so profitable? After all, the odds of winning New York’s Mega Millions jackpot are one in 302,575,350. For context, the odds of getting accepted into Harvard University after high school are one in twenty, meeting and dating a supermodel one in 88,000, and being killed by a meteor one in 1,600,000. (Instant scratch-off tickets that award much smaller prizes give players more frequent wins.) Unsurprisingly, gambling opponents sardonically refer to the lottery as a tax on stupidity. This isn’t accurate. To be sure, people are notoriously bad at estimating probability, and advertisements for the lottery lean into this quirk—slogans such as “hey, you never know” have become a part of New York’s lexicon. The promise of easy riches is certainly a hook for a lot of people new to gambling.

Yet, contrary to entrenched belief, the most mature gamblers don’t suffer from a poor grasp of probability. Natasha Dow Schül, a professor of media studies at New York University, interviewed and researched casino-goers in Las Vegas for fifteen years, finding that many understood their chances of winning a large jackpot were low. “Knowing the odds doesn’t interfere with my playing,” one of her participants stated bluntly. “Somehow that knowledge becomes irrelevant when I sit down at the machine.”

Instead, gambling creates what behaviorists call an “intermittent schedule of reinforcement” (INT). An INT is a program that rewards a completed task only part of the time, in a manner that is either difficult or impossible to predict. Because an INT involves uncertainty, gamblers experience a rush of adrenaline whenever they play. Electronic slot machines—a staple of every casino—are programmed to shorten the time between each payout, creating a frequent yet unpredictable rush of dopamine that exists for as long as the player has the funds to continue the game. The effect slot machines have on their players is eerily like that of opioids; gamblers sit for hours, sometimes days, in front of a device. Neglecting to eat or use the restroom, their eyes glaze over and they become unresponsive to their surroundings. According to Schül, emergency medical technicians especially dread responding to situations in casinos, where the primary obstacle to reaching victims are the slot players who refuse to leave their stations.

One of the questions at the heart of this debate is whether compulsive gambling is a mental illness, as opposed to a social problem. To some extent, the debate appears settled. The Diagnostic and Statistical Manual of Mental Disorders describes Gambling Disorder (GD) as “persistent and recurrent problematic gambling behavior leading to clinically significant impairment or distress,” where “the gambling behavior is not better explained by a manic episode.” It can be a lethal condition—one out of five people diagnosed with it attempt suicide. The National Council on Problem Gambling (NCPG) estimates that two million adults in the United States suffer from GD, which is less than one percent of the country’s population. However, not everyone who has deleterious gambling behavior has a diagnosable disorder; the NCPG estimates that an additional 4–6 million Americans have compulsive gambling habits. Extreme indebtedness leaves little room for speculation as to why so many try to kill themselves. In 2017, the Wisconsin affiliate of the NCPG reported that the average debt of helpline callers exceeded $34,078 dollars.

The stated position of the NCPG is that “[t]he cause of a gambling problem is the individual’s inability to control the gambling… The casino or lottery provides the opportunity for the person to gamble. It does not, in and of itself, create the problem any more than a liquor store would create an alcoholic.” In other words, compulsive gambling is an individual, psychological problem. Morally blameworthy or not, gambling addicts are personally responsible for managing their illness and seeking help.

If compulsive gambling truly is a private concern, then public policy – which typically deals only with market failures and public goods – is probably the wrong instrument for addressing it. Nor would it make sense for state governments to decide how gamblers spend their money. Back in 2004, when Maryland pushed to install video lottery terminals at racetracks, Governor Robert Ehrlich distilled this perspective during an interview with NPR’s Steve Inskeep:

Inskeep: As you see it, what’s the downside here for the state of Maryland if this proposal passes?

Gov. Ehrlich: The downside?

Inskeep: If any.

Gov. Ehrlich: Very little. Very little downside. Clearly, there will be some folks who cannot handle the expanded freedom they would receive through this additional form of gaming. As usual, it would be a very small minority; the same with beer, same with alcohol, the same with just about any other—meat, carbohydrates. Any other legal product, there will be a small percentage of people who can’t handle the freedom.

This viewpoint is changing, however. Many researchers are starting to recognize that addiction is more complicated than psychological vulnerability, and that economic conditions and social norms are highly important for understanding maladaptive behavior. This underlies the psychosocial model of addiction, where one understands “the same addictive behavior as a function of automatic cognitive priming, the result of expectancy based motivational processes and also as a social identity based phenomena.” The phrase “automatic cognitive priming” is almost custom-made to describe machine gambling. As Schül notes in her landmark book on the subject, Addiction by Design, at least one study has found that players who regularly engage with video gambling devices become addicted three times as rapidly as other gamblers. While mental health and genetic disposition both play a role, gambling addiction is also clearly a relationship between the user and the device.

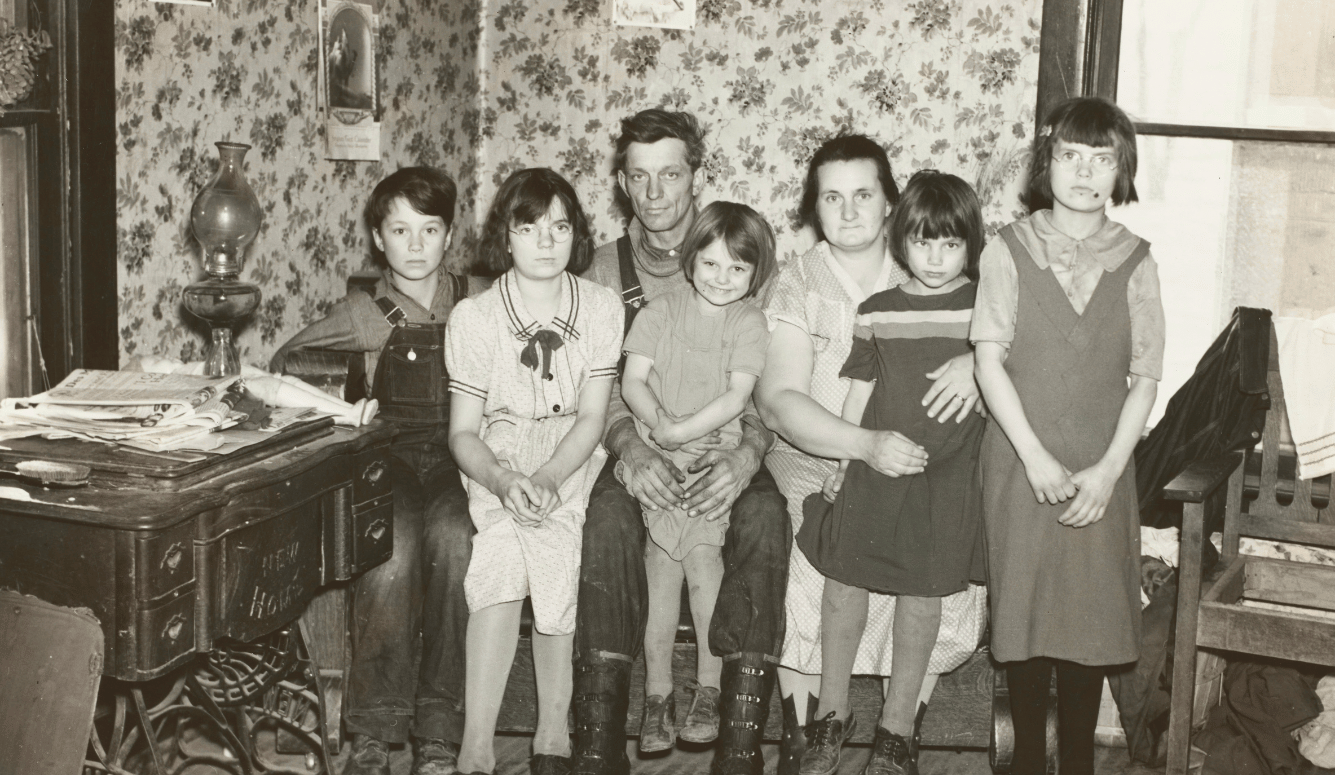

The psychosocial model reveals a clear warning against gambling through the sharp rise in deaths from alcoholism, drug overdoses, and suicide over the last twenty years. In contrast to the steadily declining mortality rates around the industrialized world within the same time period—or more strikingly, compared to other ethnic groups in the country—more white working class men and women in America have started to die before they reach the age of 65. In a report published by the Brookings Institute in 2017, economists Anne Casse and Angus Deaton memorably referred to these as “diseases of despair,” because they entice their victims with escape from a deteriorating quality of life. In one deeply unsettling passage, Casse and Deaton noted that:

Traditional structures of social and economic support slowly weakened; no longer was it possible for a man to follow his father and grandfather into a manufacturing job, or to join the union and start on the union ladder of wages. Marriage was no longer the only socially acceptable way to form intimate partnerships, or to rear children. People moved away from the security of legacy religions or the churches of their parents and grandparents, toward churches that emphasized seeking an identity, or replaced membership with the search for connection or economic success. These changes left people with less structure when they came to choose their careers, their religion, and the nature of their family lives. When such choices succeed, they are liberating; when they fail, the individual can only hold himself or herself responsible. In the worst cases of failure, this is a Durkheim-like recipe for suicide. We can see this as a failure to meet early expectations or, more fundamentally, as a loss of the structures that give life a meaning.

Put bluntly, the current environment in the United States severely constrains many people’s ability to resist instant gratification, because it is no longer clear that one’s discipline and hard work will pay off. Or, as Case and Deaton put it, “Virtue is easier to maintain when it is rewarded.” American working-class whites might only be a sign of things to come, however. According to a report by the Trust for America’s Health, millennials are also grappling with increases in deaths of despair, and similarly lack the social supports that might otherwise protect them from addiction.

Nevertheless, gambling liberalization provides measurable benefits to state governments. What is less clear is whether the increased revenue is enough to offset the social costs associated with gambling, or how durable the revenue growth is. In 2016, the Rockefeller Institute calculated that tax and fee revenue from gambling only increased by $0.5 billion dollars between 2008 and 2015 when adjusted for inflation.

While the Great Recession decreased consumer spending and shares some of the responsibility, the authors of the paper ultimately concluded that industry liberalization quickly reaches diminishing returns because of market saturation. New Jersey, for example, saw its betting revenue steadily decline after 2006, when a new casino opened in neighboring Pennsylvania and fewer patrons traveled to Atlantic City. And while concerns that gambling might drain money from local businesses are probably overblown, new games, such as electronic slot machines, simply cannibalize the revenue from older ones, like betting on horse races. There is a natural limit to how much money states can raise from fees on gambling, which makes it a worse-than-useless kludge for helping states finance their programs during economic downturns.

If lawmakers want to help their constituents fight compulsive gambling, then putting the brakes on legalization is the most impactful policy in the short term. Retroactively outlawing forms of gambling that are already legal would probably backfire. States should also scale back their advertising budgets for the lottery and use the extra money to provide more funding for problem gambling resource centers. Unfortunately, there are many problems that public policy cannot address without imposing high costs on the rest of society. The underlying social ills driven by globalization and the breakdown of community life—the kind of environmental factors that undergird deaths of despair—are ultimately side effects of a major economic transition in the United States. But we can avoid making them worse.